Form Ft-1001 - Exemption Certificate For Diesel Motor Fuel Interdistributor Transactions - Nys Department Of Taxation

ADVERTISEMENT

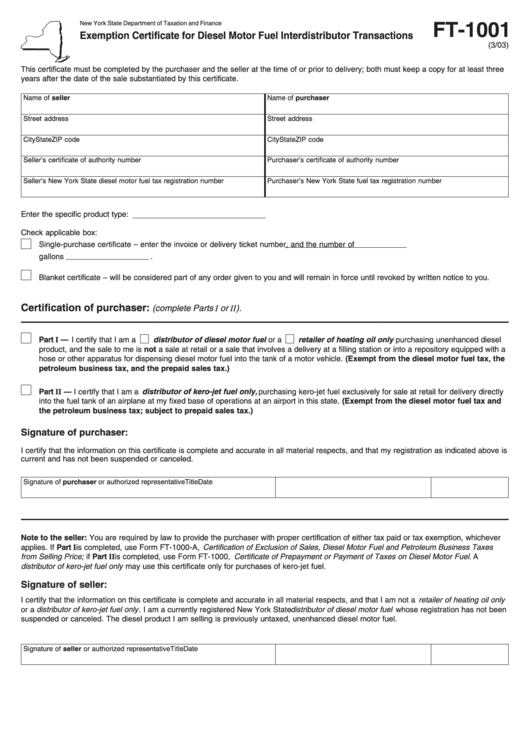

New York State Department of Taxation and Finance

FT-1001

Exemption Certificate for Diesel Motor Fuel Interdistributor Transactions

(3/03)

This certificate must be completed by the purchaser and the seller at the time of or prior to delivery; both must keep a copy for at least three

years after the date of the sale substantiated by this certificate.

Name of seller

Name of purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Seller’s certificate of authority number

Purchaser’s certificate of authority number

Seller’s New York State diesel motor fuel tax registration number

Purchaser’s New York State fuel tax registration number

Enter the specific product type:

Check applicable box:

Single-purchase certificate – enter the invoice or delivery ticket number

, and the number of

gallons

.

Blanket certificate – will be considered part of any order given to you and will remain in force until revoked by written notice to you.

Certification of purchaser:

(complete Parts I or II ).

Part I — I certify that I am a

distributor of diesel motor fuel or a

retailer of heating oil only purchasing unenhanced diesel

product, and the sale to me is not a sale at retail or a sale that involves a delivery at a filling station or into a repository equipped with a

hose or other apparatus for dispensing diesel motor fuel into the tank of a motor vehicle. (Exempt from the diesel motor fuel tax, the

petroleum business tax, and the prepaid sales tax.)

Part II — I certify that I am a distributor of kero-jet fuel only, purchasing kero-jet fuel exclusively for sale at retail for delivery directly

into the fuel tank of an airplane at my fixed base of operations at an airport in this state. (Exempt from the diesel motor fuel tax and

the petroleum business tax; subject to prepaid sales tax.)

Signature of purchaser:

I certify that the information on this certificate is complete and accurate in all material respects, and that my registration as indicated above is

current and has not been suspended or canceled.

Signature of purchaser or authorized representative

Title

Date

Note to the seller: You are required by law to provide the purchaser with proper certification of either tax paid or tax exemption, whichever

applies. If Part I is completed, use Form FT-1000-A, Certification of Exclusion of Sales, Diesel Motor Fuel and Petroleum Business Taxes

from Selling Price; if Part II is completed, use Form FT-1000, Certificate of Prepayment or Payment of Taxes on Diesel Motor Fuel. A

distributor of kero-jet fuel only may use this certificate only for purchases of kero-jet fuel.

Signature of seller:

I certify that the information on this certificate is complete and accurate in all material respects, and that I am not a retailer of heating oil only

or a distributor of kero-jet fuel only . I am a currently registered New York State distributor of diesel motor fuel whose registration has not been

suspended or canceled. The diesel product I am selling is previously untaxed, unenhanced diesel motor fuel.

Signature of seller or authorized representative

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1