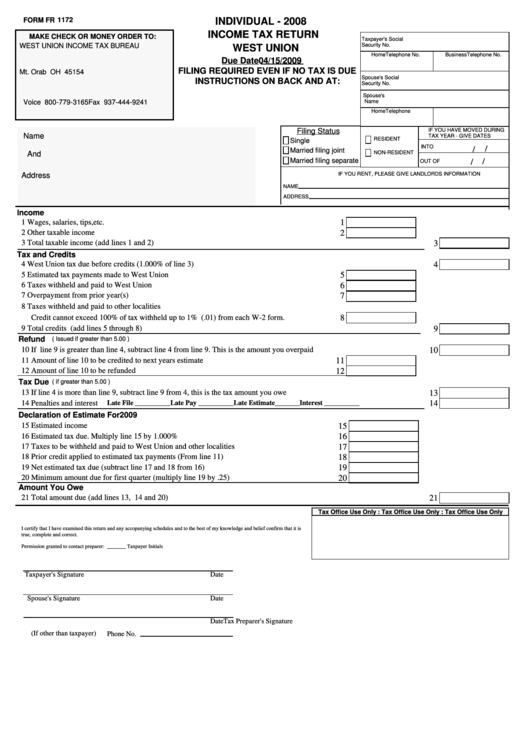

Form Fr 1172 - Individual Income Tax Return - West Union - 2008

ADVERTISEMENT

FORM FR

1172

INDIVIDUAL - 2008

INCOME TAX RETURN

MAKE CHECK OR MONEY ORDER TO:

Taxpayer's Social

WEST UNION INCOME TAX BUREAU

Security No.

WEST UNION

HomeTelephone No.

BusinessTelephone No.

Due Date 04/15/2009

P.O. Box 529

FILING REQUIRED EVEN IF NO TAX IS DUE

Mt. Orab OH 45154

Spouse's Social

INSTRUCTIONS ON BACK AND AT:

Security No.

Spouse's

Name

Voice 800-779-3165 Fax 937-444-9241

HomeTelephone No.

BusinessTelephone No.

westuniontax@fuse.net

Filing Status

IF YOU HAVE MOVED DURING

Name

TAX YEAR - GIVE DATES

RESIDENT

Single

INTO

/

/

Married filing joint

NON-RESIDENT

And

Married filing separate

/

OUT OF

/

IF YOU RENT, PLEASE GIVE LANDLORDS INFORMATION

Address

NAME

ADDRESS

Income

1 Wages, salaries, tips,etc.

1

2 Other taxable income

2

3 Total taxable income (add lines 1 and 2)

3

Tax and Credits

4 West Union tax due before credits (1.000% of line 3)

4

5 Estimated tax payments made to West Union

5

6 Taxes withheld and paid to West Union

6

7 Overpayment from prior year(s)

7

8 Taxes withheld and paid to other localities

Credit cannot exceed 100% of tax withheld up to 1% (.01) from each W-2 form.

8

9 Total credits (add lines 5 through 8)

9

Refund

( Issued if greater than 5.00 )

10 If line 9 is greater than line 4, subtract line 4 from line 9. This is the amount you overpaid

10

11 Amount of line 10 to be credited to next years estimate

11

12 Amount of line 10 to be refunded

12

Tax Due

( if greater than 5.00 )

13 If line 4 is more than line 9, subtract line 9 from 4, this is the tax amount you owe

13

14 Penalties and interest

Late File __________

Late Pay __________

Late Estimate_______

Interest __________

14

Declaration of Estimate For 2009

15 Estimated income

15

16 Estimated tax due. Multiply line 15 by 1.000%

16

17 Taxes to be withheld and paid to West Union and other localities

17

18 Prior credit applied to estimated tax payments (From line 11)

18

19 Net estimated tax due (subtract line 17 and 18 from 16)

19

20 Minimum amount due for first quarter (multiply line 19 by .25)

20

Amount You Owe

21 Total amount due (add lines 13, 14 and 20)

21

Tax Office Use Only : Tax Office Use Only : Tax Office Use Only

I certify that I have examined this return and any accopanying schedules and to the best of my knowledge and belief confirm that it is

true, complete and correct.

Permission granted to contact preparer: _______ Taxpayer Initials

Taxpayer's Signature

Date

Spouse's Signature

Date

Tax Preparer's Signature

Date

(If other than taxpayer)

Phone No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5