Occupational Privilege Tax Form - City Of Greenwood Village

ADVERTISEMENT

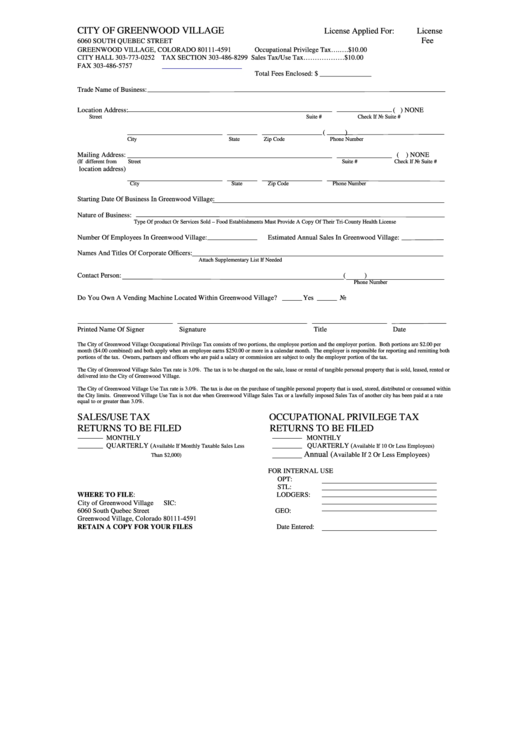

CITY OF GREENWOOD VILLAGE

License Applied For:

License

Fee

6060 SOUTH QUEBEC STREET

GREENWOOD VILLAGE, COLORADO 80111-4591

Occupational Privilege Tax….….$10.00

CITY HALL 303-773-0252 TAX SECTION 303-486-8299

Sales Tax/Use Tax………………$10.00

FAX 303-486-5757

Total Fees Enclosed: $ _______________

Trade Name of Business:

Location Address:

( ) NONE

Street

Suite #

Check If No Suite #

(

)

City

State

Zip Code

Phone Number

Mailing Address:

( ) NONE

(If different from

Street

Suite #

Check If No Suite #

location address)

City

State

Zip Code

Phone Number

Starting Date Of Business In Greenwood Village:

Nature of Business:

Type Of product Or Services Sold – Food Establishments Must Provide A Copy Of Their Tri-County Health License

Number Of Employees In Greenwood Village:

Estimated Annual Sales In Greenwood Village:

Names And Titles Of Corporate Officers:

Attach Supplementary List If Needed

Contact Person:

(

)

Phone Number

Do You Own A Vending Machine Located Within Greenwood Village?

Yes

No

Printed Name Of Signer

Signature

Title

Date

The City of Greenwood Village Occupational Privilege Tax consists of two portions, the employee portion and the employer portion. Both portions are $2.00 per

month ($4.00 combined) and both apply when an employee earns $250.00 or more in a calendar month. The employer is responsible for reporting and remitting both

portions of the tax. Owners, partners and officers who are paid a salary or commission are subject to only the employer portion of the tax.

The City of Greenwood Village Sales Tax rate is 3.0%. The tax is to be charged on the sale, lease or rental of tangible personal property that is sold, leased, rented or

delivered into the City of Greenwood Village.

The City of Greenwood Village Use Tax rate is 3.0%. The tax is due on the purchase of tangible personal property that is used, stored, distributed or consumed within

the City limits. Greenwood Village Use Tax is not due when Greenwood Village Sales Tax or a lawfully imposed Sales Tax of another city has been paid at a rate

equal to or greater than 3.0%.

SALES/USE TAX

OCCUPATIONAL PRIVILEGE TAX

RETURNS TO BE FILED

RETURNS TO BE FILED

MONTHLY

MONTHLY

QUARTERLY (

QUARTERLY (

Available If Monthly Taxable Sales Less

Available If 10 Or Less Employees)

Annual (

Available If 2 Or Less Employees)

Than $2,000)

FOR INTERNAL USE

OPT:

STL:

WHERE TO FILE:

LODGERS:

City of Greenwood Village

SIC:

6060 South Quebec Street

GEO:

Greenwood Village, Colorado 80111-4591

RETAIN A COPY FOR YOUR FILES

Date Entered:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1