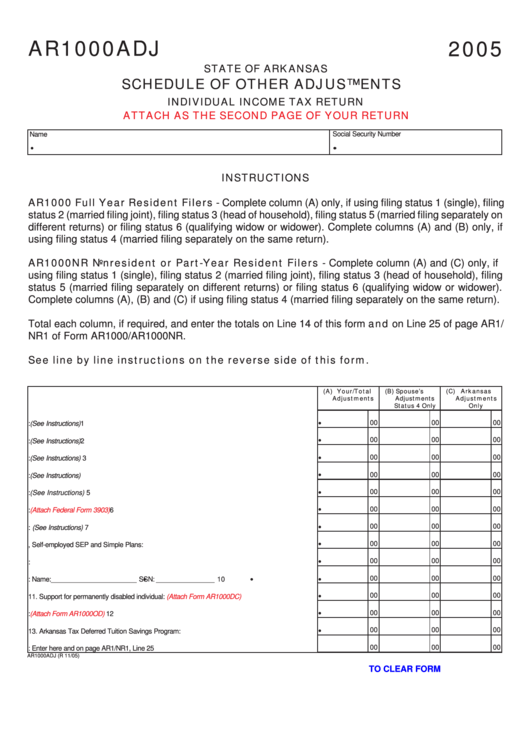

AR1000ADJ

2005

STATE OF ARKANSAS

SCHEDULE OF OTHER ADJUSTMENTS

INDIVIDUAL INCOME TAX RETURN

ATTACH AS THE SECOND PAGE OF YOUR RETURN

Name

Social Security Number

INSTRUCTIONS

AR1000 Full Year Resident Filers - Complete column (A) only, if using filing status 1 (single), filing

status 2 (married filing joint), filing status 3 (head of household), filing status 5 (married filing separately on

different returns) or filing status 6 (qualifying widow or widower). Complete columns (A) and (B) only, if

using filing status 4 (married filing separately on the same return).

AR1000NR Nonresident or Part-Year Resident Filers - Complete column (A) and (C) only, if

using filing status 1 (single), filing status 2 (married filing joint), filing status 3 (head of household), filing

status 5 (married filing separately on different returns) or filing status 6 (qualifying widow or widower).

Complete columns (A), (B) and (C) if using filing status 4 (married filing separately on the same return).

Total each column, if required, and enter the totals on Line 14 of this form and on Line 25 of page AR1/

NR1 of Form AR1000/AR1000NR.

See line by line instructions on the reverse side of this form.

(A) Your/Total

(B)

Spouse’s

(C) Arkansas

Adjustments

Adjustments

Adjustments

Status 4 Only

Only

00

00

00

1. Payments to IRA: (See Instructions) ....................................................................................... 1

00

00

00

2. Payments to MSA: (See Instructions) ...................................................................................... 2

00

00

00

3. Payments to HSA: (See Instructions) ...................................................................................... 3

00

00

00

4. Deduction for interest paid on student loans:(See Instructions) ................................................. 4

00

00

00

5. Contributions to Intergenerational Trust: (See Instructions) ....................................................... 5

00

00

00

6. Moving expenses:

(Attach Federal Form 3903)

........................................................................ 6

00

00

00

7. Self-employed health insurance deduction: (See Instructions) .................................................. 7

00

00

00

8. KEOGH, Self-employed SEP and Simple Plans: ..................................................................... 8

00

00

00

9. Forfeited interest penalty for premature withdrawal: .................................................................. 9

00

00

00

10. Alimony/Sep. Maint. paid to: Name: ______________________ SSN: _______________ 10

00

00

00

11. Support for permanently disabled individual:

(Attach Form AR1000DC)

.................................. 11

00

00

00

12. Organ Donor Deduction:

(Attach Form AR1000OD) ...............................................................

12

00

00

00

13. Arkansas Tax Deferred Tuition Savings Program: .................................................................. 13

00

00

00

14. TOTAL OTHER ADJUSTMENTS: Enter here and on page AR1/NR1, Line 25 ........................ 14

AR1000ADJ (R 11/05)

CLICK HERE TO CLEAR FORM

1

1