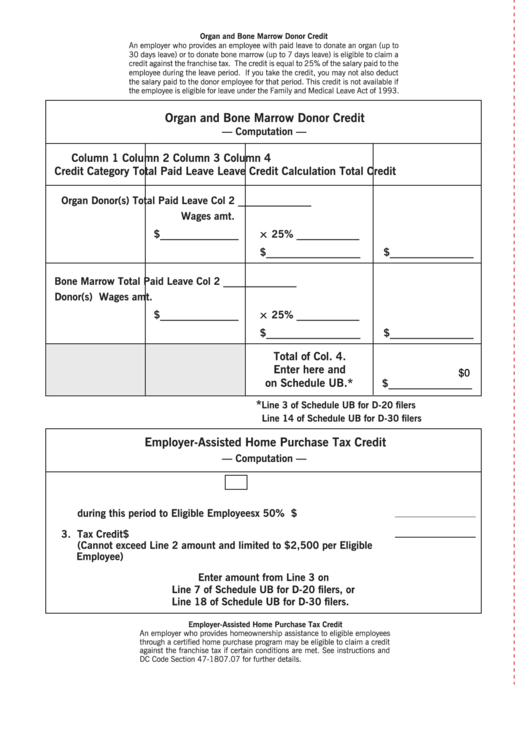

Organ and Bone Marrow Donor Credit

An employer who provides an employee with paid leave to donate an organ (up to

30 days leave) or to donate bone marrow (up to 7 days leave) is eligible to claim a

credit against the franchise tax. The credit is equal to 25% of the salary paid to the

employee during the leave period. If you take the credit, you may not also deduct

the salary paid to the donor employee for that period. This credit is not available if

the employee is eligible for leave under the Family and Medical Leave Act of 1993.

Organ and Bone Marrow Donor Credit

— Computation —

Column 1

Column 2

Column 3

Column 4

Credit Category

Total Paid Leave

Leave Credit Calculation

Total Credit

Organ Donor(s)

Total Paid Leave

Col 2 ______________

Wages

amt.

$_______________

x 25% ____________

$__________________

$________________

Bone Marrow

Total Paid Leave

Col 2 ______________

Donor(s)

Wages

amt.

$_______________

x 25% ____________

$__________________

$________________

Total of Col. 4.

Enter here and

$0

on Schedule UB.*

$________________

*

Line 3 of Schedule UB for D-20 filers

Line 14 of Schedule UB for D-30 filers

Employer-Assisted Home Purchase Tax Credit

— Computation —

1. Number of Eligible Employees

2. Amount of Homeownership Assistance provided

during this period to Eligible Employees ...........................x 50%

$

3. Tax Credit ..............................................................................

$

(Cannot exceed Line 2 amount and limited to $2,500 per Eligible

Employee)

Enter amount from Line 3 on

Line 7 of Schedule UB for D-20 filers, or

Line 18 of Schedule UB for D-30 filers.

Employer-Assisted Home Purchase Tax Credit

An employer who provides homeownership assistance to eligible employees

through a certified home purchase program may be eligible to claim a credit

against the franchise tax if certain conditions are met. See instructions and

DC Code Section 47-1807.07 for further details.

1

1