Roth Ira Conversion Request Form - (External) Convert A Traditional Ira From Another Institution To A Sterling Capital Funds Roth Ira

ADVERTISEMENT

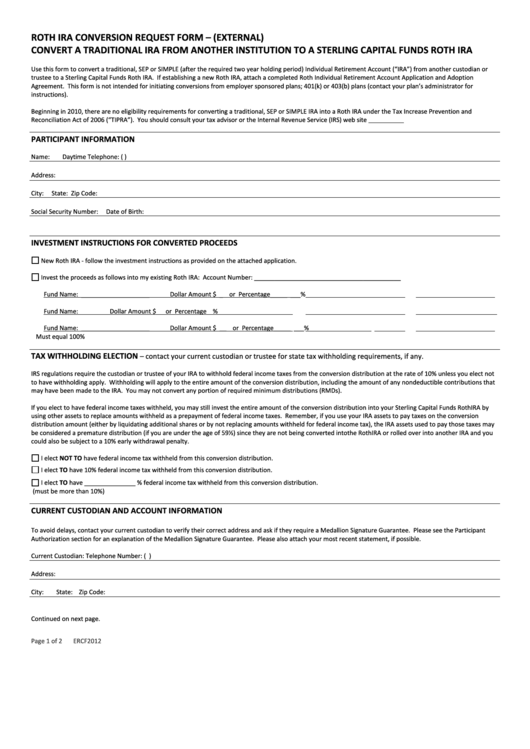

ROTH IRA CONVERSION REQUEST FORM – (EXTERNAL)

CONVERT A TRADITIONAL IRA FROM ANOTHER INSTITUTION TO A STERLING CAPITAL FUNDS ROTH IRA

Use this form to convert a traditional, SEP or SIMPLE (after the required two year holding period) Individual Retirement Account (“IRA”) from another custodian or

trustee to a Sterling Capital Funds Roth IRA. If establishing a new Roth IRA, attach a completed Roth Individual Retirement Account Application and Adoption

Agreement. This form is not intended for initiating conversions from employer sponsored plans; 401(k) or 403(b) plans (contact your plan’s administrator for

instructions).

Beginning in 2010, there are no eligibility requirements for converting a traditional, SEP or SIMPLE IRA into a Roth IRA under the Tax Increase Prevention and

Reconciliation Act of 2006 (“TIPRA”). You should consult your tax advisor or the Internal Revenue Service (IRS) web site for more information.

PARTICIPANT INFORMATION

Name:

Daytime Telephone: (

)

Address:

City:

State:

Zip Code:

Social Security Number:

Date of Birth:

INVESTMENT INSTRUCTIONS FOR CONVERTED PROCEEDS

New Roth IRA - follow the investment instructions as provided on the attached application.

Invest the proceeds as follows into my existing Roth IRA:

Account Number: ___________________________________________

Fund Name: ____________________

Dollar Amount $

_

or Percentage_____

___%

Fund Name:

Dollar Amount $

or Percentage

%

Fund Name: ____________________

Dollar Amount $

__

or Percentage_____

___%

Must equal 100%

TAX WITHHOLDING ELECTION

– contact your current custodian or trustee for state tax withholding requirements, if any.

IRS regulations require the custodian or trustee of your IRA to withhold federal income taxes from the conversion distribution at the rate of 10% unless you elect not

to have withholding apply. Withholding will apply to the entire amount of the conversion distribution, including the amount of any nondeductible contributions that

may have been made to the IRA. You may not convert any portion of required minimum distributions (RMDs).

If you elect to have federal income taxes withheld, you may still invest the entire amount of the conversion distribution into your Sterling Capital Funds Roth IRA by

using other assets to replace amounts withheld as a prepayment of federal income taxes. Remember, if you use your IRA assets to pay taxes on the conversion

distribution amount (either by liquidating additional shares or by not replacing amounts withheld for federal income tax), the IRA assets used to pay those taxes may

be considered a premature distribution (if you are under the age of 59½) since they are not being converted into the Roth IRA or rolled over into another IRA and you

could also be subject to a 10% early withdrawal penalty.

I elect NOT TO have federal income tax withheld from this conversion distribution.

I elect TO have 10% federal income tax withheld from this conversion distribution.

I elect TO have _______________ % federal income tax withheld from this conversion distribution.

(must be more than 10%)

CURRENT CUSTODIAN AND ACCOUNT INFORMATION

To avoid delays, contact your current custodian to verify their correct address and ask if they require a Medallion Signature Guarantee. Please see the Participant

Authorization section for an explanation of the Medallion Signature Guarantee. Please also attach your most recent statement, if possible.

Current Custodian:

Telephone Number: (

)

Address:

City:

State:

Zip Code:

Continued on next page.

Page 1 of 2

ERCF2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2