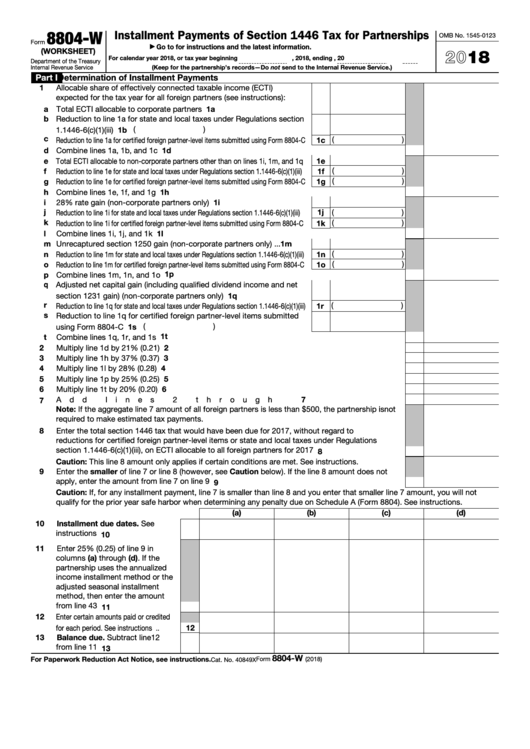

8804-W

Installment Payments of Section 1446 Tax for Partnerships

OMB No. 1545-0123

Form

Go to for instructions and the latest information.

▶

(WORKSHEET)

2018

For calendar year 2018, or tax year beginning

, 2018, ending

, 20

Department of the Treasury

Internal Revenue Service

(Keep for the partnership’s records—Do not send to the Internal Revenue Service.)

Part I

Determination of Installment Payments

1

Allocable share of effectively connected taxable income (ECTI)

expected for the tax year for all foreign partners (see instructions):

a Total ECTI allocable to corporate partners .

.

.

.

.

.

.

.

.

.

1a

b Reduction to line 1a for state and local taxes under Regulations section

1b (

)

1.1446-6(c)(1)(iii)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Reduction to line 1a for certified foreign partner-level items submitted using Form 8804-C

1c (

)

d Combine lines 1a, 1b, and 1c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1d

e Total ECTI allocable to non-corporate partners other than on lines 1i, 1m, and 1q

1e

1f (

)

f

Reduction to line 1e for state and local taxes under Regulations section 1.1446-6(c)(1)(iii)

1g (

)

g Reduction to line 1e for certified foreign partner-level items submitted using Form 8804-C

h Combine lines 1e, 1f, and 1g

1h

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

i

28% rate gain (non-corporate partners only)

.

.

.

.

.

.

.

.

.

1i

1j (

j

)

Reduction to line 1i for state and local taxes under Regulations section 1.1446-6(c)(1)(iii)

k Reduction to line 1i for certified foreign partner-level items submitted using Form 8804-C

1k (

)

l

Combine lines 1i, 1j, and 1k .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1l

m Unrecaptured section 1250 gain (non-corporate partners only)

1m

.

.

.

1n (

)

n Reduction to line 1m for state and local taxes under Regulations section 1.1446-6(c)(1)(iii)

1o (

)

o Reduction to line 1m for certified foreign partner-level items submitted using Form 8804-C

1p

p Combine lines 1m, 1n, and 1o .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

q

Adjusted net capital gain (including qualified dividend income and net

1q

section 1231 gain) (non-corporate partners only) .

.

.

.

.

.

.

.

r

1r (

)

Reduction to line 1q for state and local taxes under Regulations section 1.1446-6(c)(1)(iii)

s

Reduction to line 1q for certified foreign partner-level items submitted

1s (

)

using Form 8804-C

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1t

t

Combine lines 1q, 1r, and 1s

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Multiply line 1d by 21% (0.21) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

3

Multiply line 1h by 37% (0.37) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

4

Multiply line 1l by 28% (0.28)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Multiply line 1p by 25% (0.25) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Multiply line 1t by 20% (0.20)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Add lines 2 through 6 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

7

Note: If the aggregate line 7 amount of all foreign partners is less than $500, the partnership is not

required to make estimated tax payments.

8

Enter the total section 1446 tax that would have been due for 2017, without regard to

reductions for certified foreign partner-level items or state and local taxes under Regulations

section 1.1446-6(c)(1)(iii), on ECTI allocable to all foreign partners for 2017

.

.

.

.

.

.

.

.

8

Caution: This line 8 amount only applies if certain conditions are met. See instructions.

9

Enter the smaller of line 7 or line 8 (however, see Caution below). If the line 8 amount does not

apply, enter the amount from line 7 on line 9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Caution: If, for any installment payment, line 7 is smaller than line 8 and you enter that smaller line 7 amount, you will not

qualify for the prior year safe harbor when determining any penalty due on Schedule A (Form 8804). See instructions.

(a)

(b)

(c)

(d)

10

Installment

due

dates.

See

instructions .

.

.

.

.

.

.

10

11

Enter 25% (0.25) of line 9 in

columns (a) through (d). If the

partnership uses the annualized

income installment method or the

adjusted

seasonal

installment

method, then enter the amount

from line 43 .

.

.

.

.

.

.

11

12

Enter certain amounts paid or credited

for each period. See instructions .

.

12

13

Balance due. Subtract line 12

from line 11 .

.

.

.

.

.

.

13

8804-W

For Paperwork Reduction Act Notice, see instructions.

Form

(2018)

Cat. No. 40849X

1

1 2

2 3

3 4

4