2

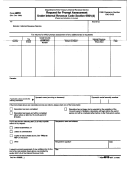

Form 4810 (Rev. 2-2009)

Page

General Instructions

not required to request prompt assessment; however,

if you do so you are required to provide the

Section references are to the Internal Revenue Code.

information requested on this form. Failure to provide

the information may delay or prevent processing your

Purpose of Form

request. Section 6109 requires you to provide the

requested taxpayer identification numbers.

Use Form 4810 to request prompt assessment of tax.

Attach to your request the documentation requested

You are not required to provide the information

on Form 4810. If you prefer to use your own format,

requested on a form that is subject to the Paperwork

your request must list the same information as

Reduction Act unless the form displays a valid OMB

requested on this form and include the applicable

control number. Books or records relating to a form or

attachments. Specifically, you must verify your

its instructions must be retained as long as their

authority to act for the taxpayers (for example, letters

contents may become material in the administration of

testamentary or letters of administration) and provide

any Internal Revenue law. Generally, tax returns and

copies of the authorizing document. Also, your request

return information are confidential as required by

must clearly show:

section 6103. However, section 6103 allows or requires

the Internal Revenue Service to disclose or give such

It is a request for prompt assessment under section

information shown on your Form 4810 to the

6501(d);

Department of Justice to enforce the tax laws, both

The kind of tax and the tax periods involved;

civil and criminal, and to cities, states, the District of

The name and social security number (SSN) or

Columbia, and U.S. commonwealths or possessions.

employer identification number (EIN) shown on the

We may also disclose this information to other

return (copies of the returns may be attached to help

countries under a tax treaty, to federal and state

identify the return; write at the top of the return copy:

agencies to enforce federal nontax criminal laws, or to

“COPY - DO NOT PROCESS AS ORIGINAL”); and

federal law enforcement and intelligence agencies to

combat terrorism.

The date and location of the IRS office where the

returns were filed.

The time needed to complete and file this form and

related schedules will vary depending on individual

When To File

circumstances. The estimated average times are:

Do not file Form 4810 requesting prompt assessment

Recordkeeping

5 hrs., 30 min.

until after you file the tax returns listed on the front of

this form. You must submit a separate request for

Learning about the law or the form

0 hrs., 18 min.

prompt assessment for any tax returns filed after this

Preparing the form

0 hrs., 24 min.

Form 4810.

Copying, assembling, and

Where To File

sending the form to the IRS

0 hrs., 0 min.

Send your request to the Internal Revenue Service

If you have comments concerning the accuracy of

Center where you filed the returns for which you are

these time estimates or suggestions for making this

requesting prompt assessment.

request simpler, we would be happy to hear from you.

You can write to the Internal Revenue Service, Tax

Products Coordinating Committee,

Privacy Act and Paperwork Reduction Act Notice.

SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW,

We ask for the information on this form to carry out the

IR-6526, Washington, DC 20224. Do not send this tax

Internal Revenue laws of the United States. We collect

form to the above address. Instead, see Where To File

this information under the authority under Internal

on this page.

Revenue Code section 6501(d). We need it to ensure

that you are complying with these laws and to allow us

to figure and collect the right amount of tax. You are

1

1 2

2