Form C-3 Employer'S Quarterly Report Instructions

ADVERTISEMENT

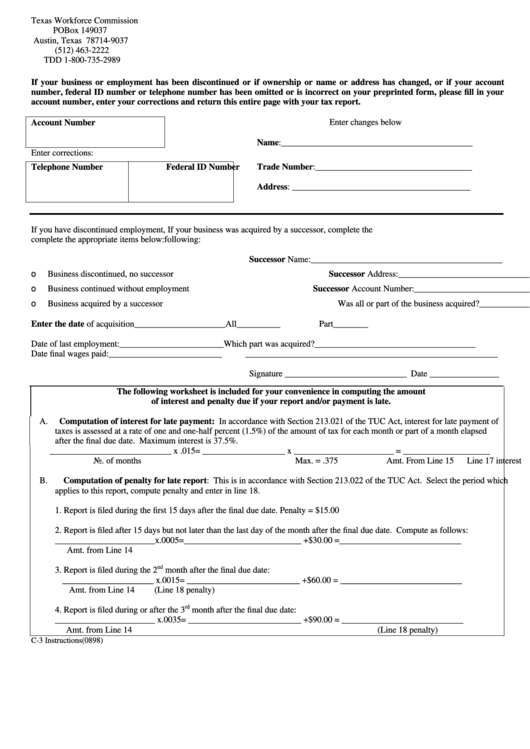

Texas Workforce Commission

P O Box 149037

Austin, Texas 78714-9037

(512) 463-2222

TDD 1-800-735-2989

If your business or employment has been discontinued or if ownership or name or address has changed, or if your account

number, federal ID number or telephone number has been omitted or is incorrect on your preprinted form, please fill in your

account number, enter your corrections and return this entire page with your tax report.

Enter changes below

Account Number

Name:____________________________________________

Enter corrections:

Trade Number:____________________________________

Telephone Number

Federal ID Number

Address: _________________________________________

If you have discontinued employment,

If your business was acquired by a successor, complete the

complete the appropriate items below:

following:

Successor Name:____________________________________________

o Business discontinued, no successor

Successor Address:__________________________________________

o Business continued without employment

Successor Account Number:___________________________________

o Business acquired by a successor

Was all or part of the business acquired?_________________________

Enter the date of acquisition_____________________

All__________

Part________

Date of last employment:________________________

Which part was acquired?_____________________________________

Date final wages paid: __________________________

__________________________________________________________

Signature ____________________________ Date ________________

The following worksheet is included for your convenience in computing the amount

of interest and penalty due if your report and/or payment is late.

A. Computation of interest for late payment: In accordance with Section 213.021 of the TUC Act, interest for late payment of

taxes is assessed at a rate of one and one-half percent (1.5%) of the amount of tax for each month or part of a month elapsed

after the final due date. Maximum interest is 37.5%.

____________________________ x .015= ___________________ x _______________________ = ____________________

No. of months

Max. = .375

Amt. From Line 15

Line 17 interest

B. Computation of penalty for late report: This is in accordance with Section 213.022 of the TUC Act. Select the period which

applies to this report, compute penalty and enter in line 18.

1. Report is filed during the first 15 days after the final due date. Penalty = $15.00

2. Report is filed after 15 days but not later than the last day of the month after the final due date. Compute as follows:

_______________________x.0005=___________________________ +$30.00 =____________________________

Amt. from Line 14

(Line 18 penalty)

nd

3. Report is filed during the 2

month after the final due date:

_____________________ x.0015= __________________________ +$60.00 = ____________________________

Amt. from Line 14

(Line 18 penalty)

rd

4. Report is filed during or after the 3

month after the final due date:

_______________________ x.0035= __________________________ +$90.00 = ____________________________

Amt. from Line 14

(Line 18 penalty)

C-3 Instructions(0898) Inv.No. 518425

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1