Form 2000 - Request For Massachusetts Forms And Publications - 1999

ADVERTISEMENT

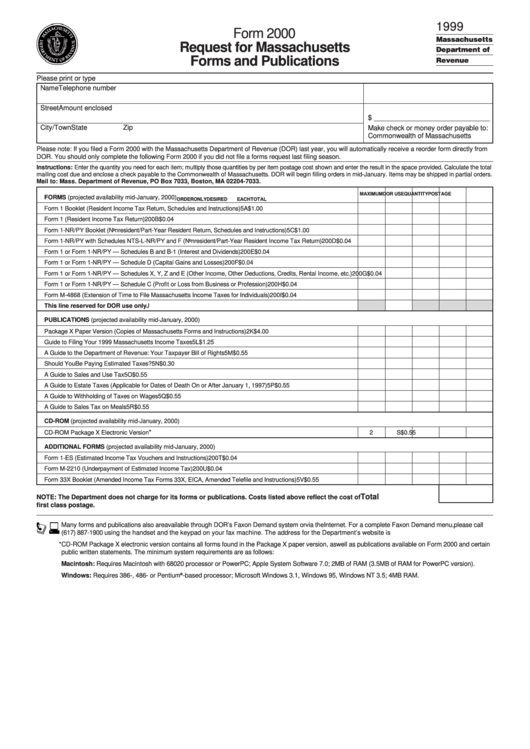

1999

Form 2000

Massachusetts

Request for Massachusetts

Department of

Forms and Publications

Revenue

Please print or type

Name

Telephone number

Street

Amount enclosed

$ ______________________________

City/Town

State

Zip

Make check or money order payable to:

Commonwealth of Massachusetts

Please note: If you filed a Form 2000 with the Massachusetts Department of Revenue (DOR) last year, you will automatically receive a reorder form directly from

DOR. You should only complete the following Form 2000 if you did not file a forms request last filing season.

Instructions: Enter the quantity you need for each item; multiply those quantities by per item postage cost shown and enter the result in the space provided. Calculate the total

mailing cost due and enclose a check payable to the Commonwealth of Massachusetts. DOR will begin filling orders in mid-January. Items may be shipped in partial orders.

Mail to: Mass. Department of Revenue, PO Box 7033, Boston, MA 02204-7033.

MAXIMUM

DOR USE QUANTITY POSTAGE

FORMS (projected availability mid-January, 2000)

ORDER

ONLY

DESIRED

EACH

TOTAL

Form 1 Booklet (Resident Income Tax Return, Schedules and Instructions)

5

A

$1.00

Form 1 (Resident Income Tax Return)

200

B

$0.04

Form 1-NR/PY Booklet (Nonresident/Part-Year Resident Return, Schedules and Instructions)

5

C

$1.00

Form 1-NR/PY with Schedules NTS-L-NR/PY and F (Nonresident/Part-Year Resident Income Tax Return)

200

D

$0.04

Form 1 or Form 1-NR/PY — Schedules B and B-1 (Interest and Dividends)

200

E

$0.04

Form 1 or Form 1-NR/PY — Schedule D (Capital Gains and Losses)

200

F

$0.04

Form 1 or Form 1-NR/PY — Schedules X, Y, Z and E (Other Income, Other Deductions, Credits, Rental Income, etc.)

200

G

$0.04

Form 1 or Form 1-NR/PY — Schedule C (Profit or Loss from Business or Profession)

200

H

$0.04

Form M-4868 (Extension of Time to File Massachusetts Income Taxes for Individuals)

200

I

$0.04

This line reserved for DOR use only

J

PUBLICATIONS (projected availability mid-January, 2000)

Package X Paper Version (Copies of Massachusetts Forms and Instructions)

2

K

$4.00

Guide to Filing Your 1999 Massachusetts Income Taxes

5

L

$1.25

A Guide to the Department of Revenue: Your Taxpayer Bill of Rights

5

M

$0.55

Should You Be Paying Estimated Taxes?

5

N

$0.30

A Guide to Sales and Use Tax

5

O

$0.55

A Guide to Estate Taxes (Applicable for Dates of Death On or After January 1, 1997)

5

P

$0.55

A Guide to Withholding of Taxes on Wages

5

Q

$0.55

A Guide to Sales Tax on Meals

5

R

$0.55

CD-ROM (projected availability mid-January, 2000)

*

CD-ROM Package X Electronic Version

2

S

$0.55

ADDITIONAL FORMS (projected availability mid-January, 2000)

Form 1-ES (Estimated Income Tax Vouchers and Instructions)

200

T

$0.04

Form M-2210 (Underpayment of Estimated Income Tax)

200

U

$0.04

Form 33X Booklet (Amended Income Tax Forms 33X, EICA, Amended Telefile and Instructions)

5

V

$0.55

Total

NOTE: The Department does not charge for its forms or publications. Costs listed above reflect the cost of

first class postage.

Many forms and publications also are available through DOR’s Fax on Demand system or via the Internet. For a complete Fax on Demand menu, please call

(617) 887-1900 using the handset and the keypad on your fax machine. The address for the Department’s website is

*CD-ROM Package X electronic version contains all forms found in the Package X paper version, as well as publications available on Form 2000 and certain

public written statements. The minimum system requirements are as follows:

Macintosh: Requires Macintosh with 68020 processor or PowerPC; Apple System Software 7.0; 2MB of RAM (3.5MB of RAM for PowerPC version).

Windows: Requires 386-, 486- or Pentium

®

-based processor; Microsoft Windows 3.1, Windows 95, Windows NT 3.5; 4MB RAM.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1