Form L1040 - City Of Lapeer Income Tax Individual Return - 2001

ADVERTISEMENT

L#44709-NUT01

1/7/02

4:47 PM

Page 2

□

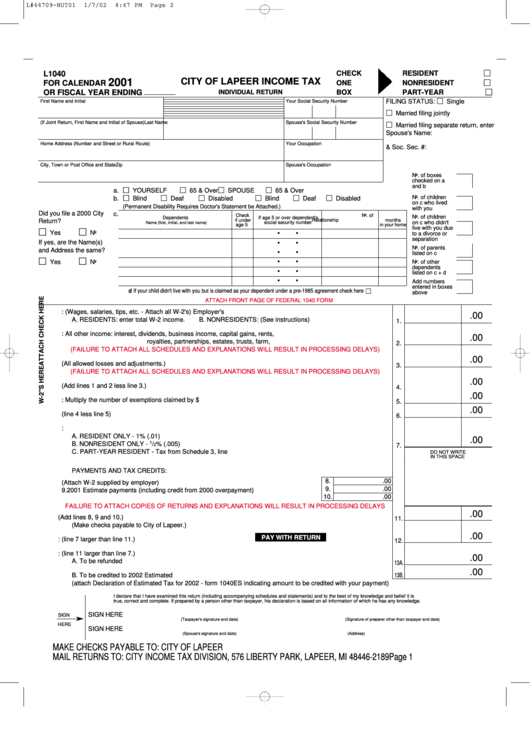

L1040

CHECK

RESIDENT

CITY OF LAPEER INCOME TAX

□

2001

FOR CALENDAR

ONE

NONRESIDENT

□

INDIVIDUAL RETURN

OR FISCAL YEAR ENDING

BOX

PART-YEAR

FILING STATUS: □ Single

First Name and Initial

Your Social Security Number

□ Married filing jointly

(If Joint Return, First Name and Initial of Spouse)

Last Name

Spouse's Social Security Number

□ Married filing separate return, enter

Spouse's Name:

Home Address (Number and Street or Rural Route)

Your Occupation

& Soc. Sec. #:

City, Town or Post Office and State

Zip

Spouse's Occupation

No. of boxes

checked on a

and b

a. □ YOURSELF

□ 65 & Over

□ SPOUSE

□ 65 & Over

b. □ Blind

□ Deaf

□ Disabled

□ Blind

□ Deaf

□ Disabled

No. of children

on c who lived

(Permanent Disability Requires Doctor's Statement be Attached.)

with you

Did you file a 2000 City

c.

Check

No. of

No. of children

Dependents

If age 5 or over dependent's

if under

Relationship

months

Return? . . . . . . . . . . . .

on c who didn't

social security number

Name (first, initial, and last name)

age 5

in your home

live with you due

□

□

Yes

No

•

•

to a divorce or

separation

If yes, are the Name(s)

•

•

No. of parents

and Address the same?

•

•

listed on c

□

□

•

•

Yes

No

No. of other

dependents

•

•

listed on c + d

•

•

Add numbers

entered in boxes

d If your child didn't live with you but is claimed as your dependent under a pre-1985 agreement check here ....................... □

above

ATTACH FRONT PAGE OF FEDERAL 1040 FORM

1. TOTAL INCOME: (Wages, salaries, tips, etc. - Attach all W-2's) Employer's Name...................................................

.00

A. RESIDENTS: enter total W-2 income.

B. NONRESIDENTS: (See instructions) .............................................

1.

2. ADDITIONS TO INCOME: All other income: interest, dividends, business income, capital gains, rents,

.00

ADDITIONS TO INOCME:

royalties, partnerships, estates, trusts, farm, etc..............................................................

2.

(FAILURE TO ATTACH ALL SCHEDULES AND EXPLANATIONS WILL RESULT IN PROCESSING DELAYS)

.00

3. SUBTRACTIONS FROM INCOME (All allowed losses and adjustments.) .................................................................

3.

(FAILURE TO ATTACH ALL SCHEDULES AND EXPLANATIONS WILL RESULT IN PROCESSING DELAYS)

.00

4. ADJUSTED INCOME (Add lines 1 and 2 less line 3.).................................................................................................

4.

.00

5. EXEMPTIONS: Multiply the number of exemptions claimed by $600.00....................................................................

5.

.00

6. TAXABLE INCOME (line 4 less line 5)........................................................................................................................

6.

7. TAX - Multiply amount on line 6 by one of the following:

A. RESIDENT ONLY - 1% (.01) ..................................................................................................................................

.00

1

B. NONRESIDENT ONLY -

/

% (.005) ......................................................................................................................

2

7.

C. PART-YEAR RESIDENT - Tax from Schedule 3, line I ..........................................................................................

DO NOT WRITE

IN THIS SPACE

PAYMENTS AND TAX CREDITS:

8.

.00

8. Lapeer tax withheld (Attach W-2 supplied by employer) ....................................................

9.

.00

9. 2001 Estimate payments (including credit from 2000 overpayment) ..................................

10.

.00

10. Credits for income tax paid to another Michigan municipality or by a partnership..............

FAILURE TO ATTACH COPIES OF RETURNS AND EXPLANATIONS WILL RESULT IN PROCESSING DELAYS

.00

11. TOTAL PAYMENTS AND CREDITS (Add lines 8, 9 and 10.) ....................................................................................

11.

(Make checks payable to City of Lapeer.)

.00

PAY WITH RETURN

12. BALANCE DUE: (line 7 larger than line 11.) ...............................................................................................................

12.

13. OVERPAYMENT: (line 11 larger than line 7.)

.00

A. To be refunded .......................................................................................................................................................

13A.

.00

B. To be credited to 2002 Estimated tax .....................................................................................................................

13B.

(attach Declaration of Estimated Tax for 2002 - form 1040ES indicating amount to be credited with your payment)

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is

true, correct and complete. If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

SIGN HERE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SIGN

(Taxpayer's signature and date)

(Signature of preparer other than taxpayer and date)

HERE

SIGN HERE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Spouse's signature and date)

(Address)

(Telephone)

MAKE CHECKS PAYABLE TO: CITY OF LAPEER

MAIL RETURNS TO: CITY INCOME TAX DIVISION, 576 LIBERTY PARK, LAPEER, MI 48446-2189

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2