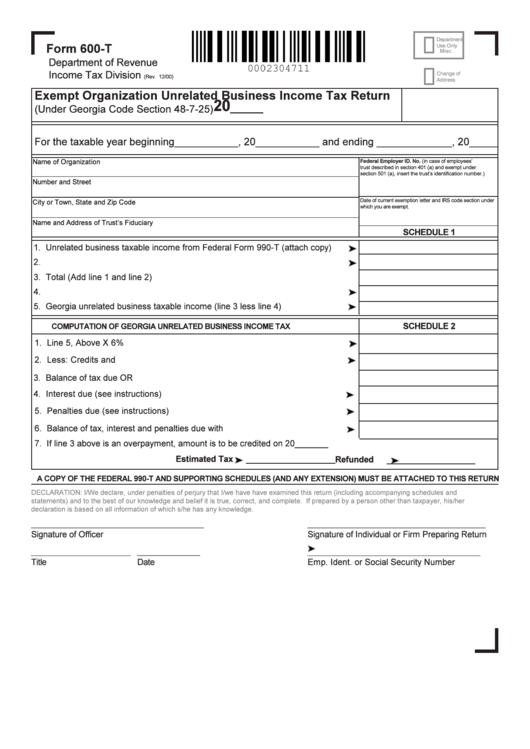

Form 600-T - Exempt Organization Unrelated Business Income Tax Return

ADVERTISEMENT

Department

Form 600-T

Use Only

Misc.

Department of Revenue

Income Tax Division

Change of

(Rev. 12/00)

Address

Exempt Organization Unrelated Business Income Tax Return

20

_____

(Under Georgia Code Section 48-7-25)

For the taxable year beginning___________, 20___________ and ending _____________, 20_____

Name of Organization

Federal Employer ID. No. (in case of employees’

trust described in section 401 (a) and exempt under

section 501 (a), insert the trust’s identification number.)

Number and Street

Date of current exemption letter and IRS code section under

City or Town, State and Zip Code

which you are exempt.

Name and Address of Trust’s Fiduciary

SCHEDULE 1

1. Unrelated business taxable income from Federal Form 990-T (attach copy).........

2. Additions.......................................................................................................

3. Total (Add line 1 and line 2).................................................................................

4. Subtractions..................................................................................................

5. Georgia unrelated business taxable income (line 3 less line 4)...........................

SCHEDULE 2

COMPUTATION OF GEORGIA UNRELATED BUSINESS INCOME TAX

1. Line 5, Above X 6%........................................................................................

2. Less: Credits and Payments..........................................................................

3. Balance of tax due OR overpayment...................................................................

4. Interest due (see instructions)........................................................................

5. Penalties due (see instructions).....................................................................

6. Balance of tax, interest and penalties due with return.......................................

7. If line 3 above is an overpayment, amount is to be credited on 20_______

Estimated Tax

___________________

Refunded

___________________

A COPY OF THE FEDERAL 990-T AND SUPPORTING SCHEDULES (AND ANY EXTENSION) MUST BE ATTACHED TO THIS RETURN

DECLARATION: I/We declare, under penalties of perjury that I/we have have examined this return (including accompanying schedules and

statements) and to the best of our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, his/her

declaration is based on all information of which s/he has any knowledge.

_________________________________

__________________________________

Signature of Officer

Signature of Individual or Firm Preparing Return

___________________

____________

_________________________________

Title

Date

Emp. Ident. or Social Security Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1