City Of Orange Beach Tax Return Form - 2016

ADVERTISEMENT

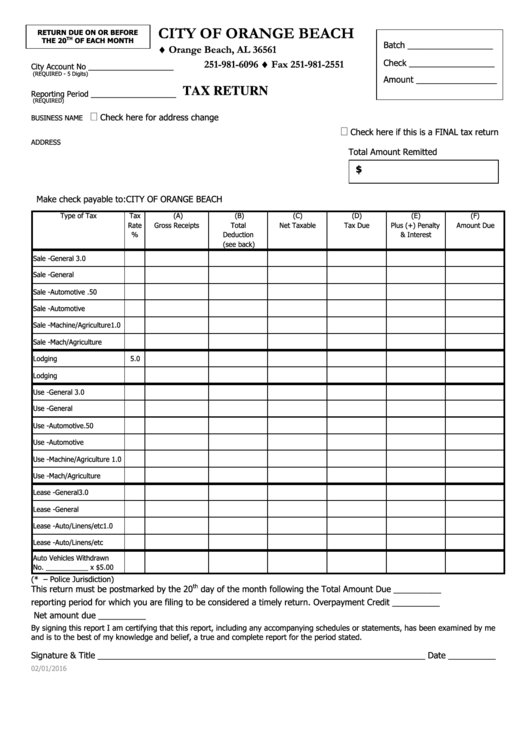

CITY OF ORANGE BEACH

RETURN DUE ON OR BEFORE

TH

THE 20

OF EACH MONTH

Batch __________________

P.O. Box 1159 Orange Beach, AL 36561

251-981-6096 Fax 251-981-2551

Check __________________

City Account No ____________________

(REQUIRED - 5 Digits)

Amount _________________

TAX RETURN

Reporting Period ____________________

(REQUIRED)

Check here for address change

BUSINESS NAME

Check here if this is a FINAL tax return

ADDRESS

Total Amount Remitted

$

Make check payable to: CITY OF ORANGE BEACH

Type of Tax

Tax

(A)

(B)

(C)

(D)

(E)

(F)

Rate

Gross Receipts

Total

Net Taxable

Tax Due

Plus (+) Penalty

Amount Due

%

Deduction

& Interest

(see back)

Sale -General

3.0

Sale -General P.J.

1.5

Sale -Automotive

.50

Sale -Automotive P.J.

.25

Sale -Machine/Agriculture

1.0

Sale -Mach/Agriculture P.J.

.50

Lodging

5.0

Lodging P.J.

2.5

Use -General

3.0

Use -General P.J.

1.5

Use -Automotive

.50

Use -Automotive P.J.

.25

Use -Machine/Agriculture

1.0

Use -Mach/Agriculture P.J.

.50

Lease -General

3.0

Lease -General P.J.

1.5

Lease -Auto/Linens/etc

1.0

Lease -Auto/Linens/etc P.J.

.05

Auto Vehicles Withdrawn

No. ___________ x $5.00

(* P.J. – Police Jurisdiction)

th

This return must be postmarked by the 20

day of the month following the

Total Amount Due

__________

reporting period for which you are filing to be considered a timely return.

Overpayment Credit

__________

Net amount due

__________

By signing this report I am certifying that this report, including any accompanying schedules or statements, has been examined by me

and is to the best of my knowledge and belief, a true and complete report for the period stated.

Signature & Title _____________________________________________________________________ Date __________

02/01/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2