Reset Form

Print Form

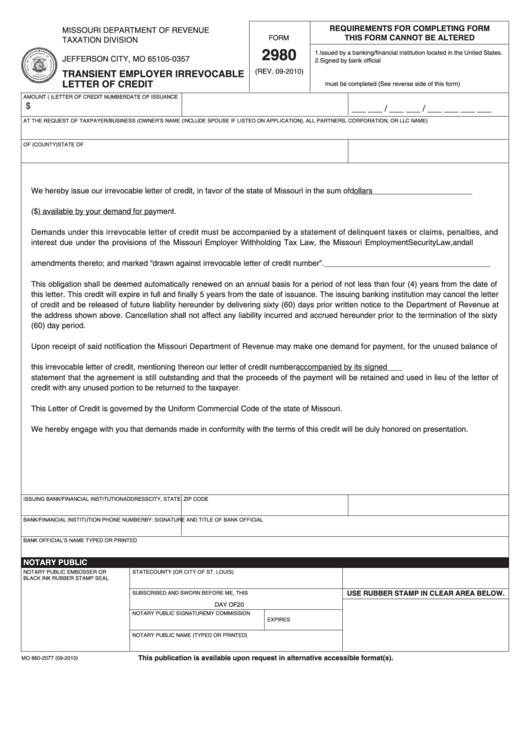

REQUIREMENTS FOR COMPLETING FORM

MISSOURI DEPARTMENT OF REVENUE

THIS FORM CANNOT BE ALTERED

FORM

TAXATION DIVISION

P.O. BOX 357

2980

1. Issued by a banking/financial institution located in the United States.

JEFFERSON CITY, MO 65105-0357

2. Signed by bank official

3. Must be notarized

(REV. 09-2010)

TRANSIENT EMPLOYER IRREVOCABLE

4. Authorization for Release of Confidential Information

LETTER OF CREDIT

must be completed (See reverse side of this form)

AMOUNT (U.S. CURRENCY)

LETTER OF CREDIT NUMBER

DATE OF ISSUANCE

$

___ ___ / ___ ___ / ___ ___ ___ ___

AT THE REQUEST OF TAXPAYER/BUSINESS (OWNER’S NAME (INCLUDE SPOUSE IF LISTED ON APPLICATION), ALL PARTNERS, CORPORATION, OR LLC NAME)

OF (COUNTY)

STATE OF

We hereby issue our irrevocable letter of credit, in favor of the state of Missouri in the sum of

dollars

($

) available by your demand for payment.

Demands under this irrevocable letter of credit must be accompanied by a statement of delinquent taxes or claims, penalties, and

interest due under the provisions of the Missouri Employer Withholding Tax Law, the Missouri Employment Security Law, and all

amendments thereto; and marked “drawn against irrevocable letter of credit number

”.

This obligation shall be deemed automatically renewed on an annual basis for a period of not less than four (4) years from the date of

this letter. This credit will expire in full and finally 5 years from the date of issuance. The issuing banking institution may cancel the letter

of credit and be released of future liability hereunder by delivering sixty (60) days prior written notice to the Department of Revenue at

the address shown above. Cancellation shall not affect any liability incurred and accrued hereunder prior to the termination of the sixty

(60) day period.

Upon receipt of said notification the Missouri Department of Revenue may make one demand for payment, for the unused balance of

this irrevocable letter of credit, mentioning thereon our letter of credit number

accompanied by its signed

statement that the agreement is still outstanding and that the proceeds of the payment will be retained and used in lieu of the letter of

credit with any unused portion to be returned to the taxpayer.

This Letter of Credit is governed by the Uniform Commercial Code of the state of Missouri.

We hereby engage with you that demands made in conformity with the terms of this credit will be duly honored on presentation.

ISSUING BANK/FINANCIAL INSTITUTION

ADDRESS

CITY, STATE, ZIP CODE

BANK/FINANCIAL INSTITUTION PHONE NUMBER

BY: SIGNATURE AND TITLE OF BANK OFFICIAL

BANK OFFICIAL’S NAME TYPED OR PRINTED

NOTARY PUBLIC

NOTARY PUBLIC EMBOSSER OR

STATE

COUNTY (OR CITY OF ST. LOUIS)

BLACK INK RUBBER STAMP SEAL

SUBSCRIBED AND SWORN BEFORE ME, THIS

USE RUBBER STAMP IN CLEAR AREA BELOW.

DAY OF

20

NOTARY PUBLIC SIGNATURE

MY COMMISSION

EXPIRES

NOTARY PUBLIC NAME (TYPED OR PRINTED)

This publication is available upon request in alternative accessible format(s).

MO 860-2077 (09-2010)

1

1 2

2