Form Cw-3 - Employer'S Municipal Tax Withholding Reconciliation - City Of Cuyahoga Falls Division Of Taxation - 2004

ADVERTISEMENT

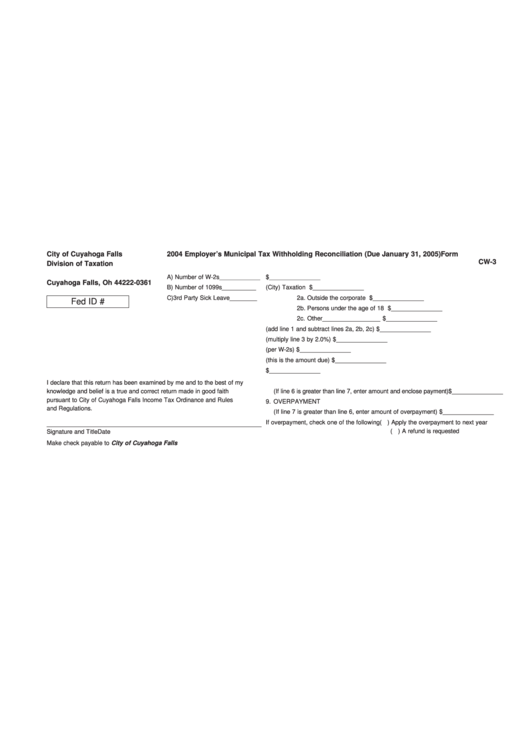

City of Cuyahoga Falls

2004 Employer’s Municipal Tax Withholding Reconciliation (Due January 31, 2005)

Form

CW-3

Division of Taxation

P.O. Box 361

A) Number of W-2s ____________

1. Total payroll for 2004 ............................................................................$_______________

Cuyahoga Falls, Oh 44222-0361

B) Number of 1099s __________

2. Payroll not subject to Cuyahoga Falls (City) Taxation ..........................$_______________

C) 3rd Party Sick Leave ________

2a. Outside the corporate limits ..............................................$_______________

Fed ID #

2b. Persons under the age of 18 ............................................$_______________

2c. Other_________________ ..............................................$_______________

3. Payroll subject to City tax (add line 1 and subtract lines 2a, 2b, 2c)....$_______________

4. City withholding tax rate (multiply line 3 by 2.0%) ................................$_______________

5. Amount withheld from employees (per W-2s) ......................................$_______________

6. Enter larger amount of line 4 or line 5 (this is the amount due) ..........$_______________

7. Total Cuyahoga Falls withholding tax remitted......................................$_______________

8. UNDERPAYMENT ................................................................................

I declare that this return has been examined by me and to the best of my

knowledge and belief is a true and correct return made in good faith

(If line 6 is greater than line 7, enter amount and enclose payment) ......$_______________

pursuant to City of Cuyahoga Falls Income Tax Ordinance and Rules

9. OVERPAYMENT

and Regulations.

(If line 7 is greater than line 6, enter amount of overpayment) ............$_______________

If overpayment, check one of the following

( ) Apply the overpayment to next year

_______________________________________________________________

( ) A refund is requested

Signature and Title

Date

Make check payable to City of Cuyahoga Falls

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1