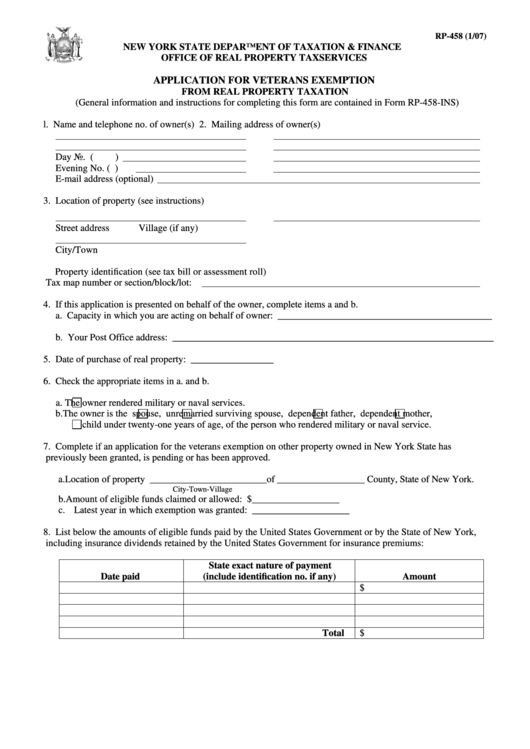

RP-458 (1/07)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR VETERANS EXEMPTION

FROM REAL PROPERTY TAXATION

(General information and instructions for completing this form are contained in Form RP-458-INS)

l. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property (see instructions)

Street address

Village (if any)

City/Town

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot:

4. If this application is presented on behalf of the owner, complete items a and b.

a. Capacity in which you are acting on behalf of owner: ____________________________________________

b. Your Post Office address: __________________________________________________________________

5. Date of purchase of real property: _________________

6. Check the appropriate items in a. and b.

a.

The owner rendered military or naval services.

b. The owner is the

spouse,

unremarried surviving spouse,

dependent father,

dependent mother,

child under twenty-one years of age, of the person who rendered military or naval service.

7. Complete if an application for the veterans exemption on other property owned in New York State has

previously been granted, is pending or has been approved.

a. Location of property ________________________of __________________ County, State of New York.

City-Town-Village

b. Amount of eligible funds claimed or allowed: $__________________

c. Latest year in which exemption was granted: ____________________

8. List below the amounts of eligible funds paid by the United States Government or by the State of New York,

including insurance dividends retained by the United States Government for insurance premiums:

State exact nature of payment

Date paid

(include identification no. if any)

Amount

$

$

Total

1

1 2

2