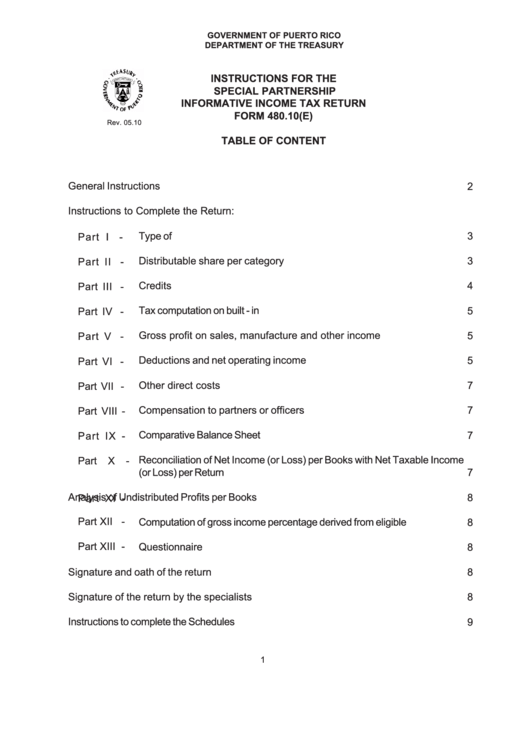

Instructions For The Special Partnership Informative Income Tax Return Form 480.10(E)

ADVERTISEMENT

GOVERNMENT OF PUERTO RICO

DEPARTMENT OF THE TREASURY

INSTRUCTIONS FOR THE

SPECIAL PARTNERSHIP

INFORMATIVE INCOME TAX RETURN

FORM 480.10(E)

Rev. 05.10

TABLE OF CONTENT

General Instructions ........................................................................................................

2

Instructions to Complete the Return:

Type of exemption........................................................................................

3

Part I

-

Distributable share per category .............................................................

3

Part II -

Credits ....................................................................................................

4

Part III -

Tax computation on built - in gain...................................................................

5

Part IV -

Gross profit on sales, manufacture and other income ...........................

5

Part V -

Deductions and net operating income ......................................................

5

Part VI -

Other direct costs ..................................................................................

7

Part VII -

Compensation to partners or officers ......................................................

7

Part VIII -

Comparative Balance Sheet ...........................................................................

7

Part IX -

Reconciliation of Net Income (or Loss) per Books with Net Taxable Income

Part X -

(or Loss) per Return ..........................................................................................

7

Analysis of Undistributed Profits per Books ...............................................

8

Part XI -

Part XII -

Computation of gross income percentage derived from eligible activities......

8

Part XIII -

Questionnaire ...........................................................................................

8

Signature and oath of the return ......................................................................................

8

Signature of the return by the specialists ........................................................................

8

Instructions to complete the Schedules .....................................................................................

9

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9