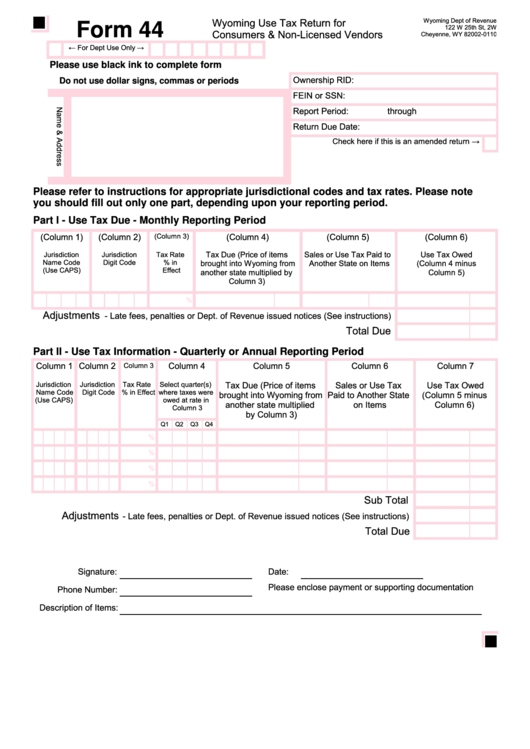

Form 44 - Wyoming Use Tax Return For Consumers & Non-Licensed Vendors

ADVERTISEMENT

Wyoming Use Tax Return for

Wyoming Dept of Revenue

Form 44

122 W 25th St, 2W

Consumers & Non-Licensed Vendors

Cheyenne, WY 82002-0110

Please use black ink to complete form

Ownership RID:

Do not use dollar signs, commas or periods

FEIN or SSN:

Report Period:

through

Return Due Date:

Please refer to instructions for appropriate jurisdictional codes and tax rates. Please note

you should fill out only one part, depending upon your reporting period.

Part I - Use Tax Due - Monthly Reporting Period

(Column 1)

(Column 2)

(Column 3)

(Column 4)

(Column 5)

(Column 6)

Jurisdiction

Jurisdiction

Tax Rate

Tax Due (Price of items

Sales or Use Tax Paid to

Use Tax Owed

Name Code

Digit Code

% in

brought into Wyoming from

Another State on Items

(Column 4 minus

(Use CAPS)

Effect

another state multiplied by

Column 5)

Column 3)

%

Adjustments

- Late fees, penalties or Dept. of Revenue issued notices (See instructions)

Total Due

Part II - Use Tax Information - Quarterly or Annual Reporting Period

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Jurisdiction

Jurisdiction

Tax Rate

Select quarter(s)

Tax Due (Price of items

Sales or Use Tax

Use Tax Owed

Name Code

Digit Code

% in Effect

where taxes were

brought into Wyoming from

Paid to Another State

(Column 5 minus

(Use CAPS)

owed at rate in

another state multiplied

on Items

Column 6)

Column 3

by Column 3)

Q1

Q2

Q3

Q4

%

%

%

%

Sub Total

Adjustments

- Late fees, penalties or Dept. of Revenue issued notices (See instructions)

Total Due

Signature:

Date:

Please enclose payment or supporting documentation

Phone Number:

Description of Items:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1