Instructions For Schedule L Of W-1040r - City Of Walker Income Tax

ADVERTISEMENT

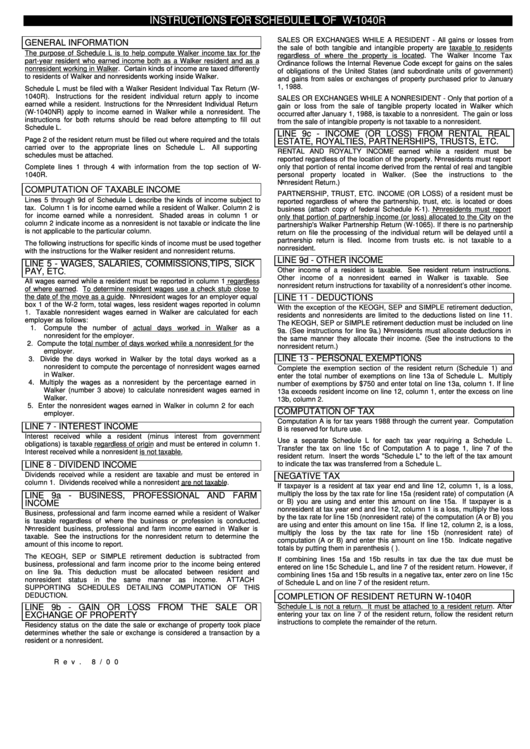

INSTRUCTIONS FOR SCHEDULE L OF W-1040R

SALES OR EXCHANGES WHILE A RESIDENT - All gains or losses from

GENERAL INFORMATION

the sale of both tangible and intangible property are taxable to residents

The purpose of Schedule L is to help compute Walker income tax for the

regardless of where the property is located. The Walker Income Tax

part-year resident who earned income both as a Walker resident and as a

Ordinance follows the Internal Revenue Code except for gains on the sales

nonresident working in Walker. Certain kinds of income are taxed differently

of obligations of the United States (and subordinate units of government)

to residents of Walker and nonresidents working inside Walker.

and gains from sales or exchanges of property purchased prior to January

1, 1988.

Schedule L must be filed with a Walker Resident Individual Tax Return (W-

1040R).

Instructions for the resident individual return apply to income

SALES OR EXCHANGES WHILE A NONRESIDENT - Only that portion of a

earned while a resident. Instructions for the Nonresident Individual Return

gain or loss from the sale of tangible property located in Walker which

(W-1040NR) apply to income earned in Walker while a nonresident. The

occurred after January 1, 1988, is taxable to a nonresident. The gain or loss

instructions for both returns should be read before attempting to fill out

from the sale of intangible property is not taxable to a nonresident.

Schedule L.

LINE 9c - INCOME (OR LOSS) FROM RENTAL REAL

Page 2 of the resident return must be filled out where required and the totals

ESTATE, ROYALTIES, PARTNERSHIPS, TRUSTS, ETC.

carried over to the appropriate lines on Schedule L.

All supporting

RENTAL AND ROYALTY INCOME earned while a resident must be

schedules must be attached.

reported regardless of the location of the property. Nonresidents must report

Complete lines 1 through 4 with information from the top section of W-

only that portion of rental income derived from the rental of real and tangible

personal property located in Walker. (See the instructions to the

1040R.

Nonresident Return.)

COMPUTATION OF TAXABLE INCOME

PARTNERSHIP, TRUST, ETC. INCOME (OR LOSS) of a resident must be

Lines 5 through 9d of Schedule L describe the kinds of income subject to

reported regardless of where the partnership, trust, etc. is located or does

tax. Column 1 is for income earned while a resident of Walker. Column 2 is

business (attach copy of federal Schedule K-1). Nonresidents must report

for income earned while a nonresident.

Shaded areas in column 1 or

only that portion of partnership income (or loss) allocated to the City on the

column 2 indicate income as a nonresident is not taxable or indicate the line

partnership's Walker Partnership Return (W-1065). If there is no partnership

is not applicable to the particular column.

return on file the processing of the individual return will be delayed until a

partnership return is filed.

Income from trusts etc. is not taxable to a

The following instructions for specific kinds of income must be used together

nonresident.

with the instructions for the Walker resident and nonresident returns.

LINE 9d - OTHER INCOME

LINE 5 - WAGES, SALARIES, COMMISSIONS, TIPS, SICK

Other income of a resident is taxable. See resident return instructions.

PAY, ETC

.

Other income of a nonresident earned in Walker is taxable.

See

All wages earned while a resident must be reported in column 1 regardless

nonresident return instructions for taxability of a nonresident’s other income.

of where earned. To determine resident wages use a check stub close to

the date of the move as a guide. Nonresident wages for an employer equal

LINE 11 - DEDUCTIONS

box 1 of the W-2 form, total wages, less resident wages reported in column

With the exception of the KEOGH, SEP and SIMPLE retirement deduction,

1. Taxable nonresident wages earned in Walker are calculated for each

residents and nonresidents are limited to the deductions listed on line 11.

employer as follows:

The KEOGH, SEP or SIMPLE retirement deduction must be included on line

1. Compute the number of actual days worked in Walker as a

9a. (See instructions for line 9a.) Nonresidents must allocate deductions in

nonresident for the employer.

the same manner they allocate their income. (See the instructions to the

2. Compute the total number of days worked while a nonresident for the

nonresident return.)

employer.

LINE 13 - PERSONAL EXEMPTIONS

3. Divide the days worked in Walker by the total days worked as a

nonresident to compute the percentage of nonresident wages earned

Complete the exemption section of the resident return (Schedule 1) and

in Walker.

enter the total number of exemptions on line 13a of Schedule L. Multiply

4. Multiply the wages as a nonresident by the percentage earned in

number of exemptions by $750 and enter total on line 13a, column 1. If line

Walker (number 3 above) to calculate nonresident wages earned in

13a exceeds resident income on line 12, column 1, enter the excess on line

Walker.

13b, column 2.

5. Enter the nonresident wages earned in Walker in column 2 for each

COMPUTATION OF TAX

employer.

Computation A is for tax years 1988 through the current year. Computation

LINE 7 - INTEREST INCOME

B is reserved for future use.

Interest received while a resident (minus interest from government

Use a separate Schedule L for each tax year requiring a Schedule L.

obligations) is taxable regardless of origin and must be entered in column 1.

Transfer the tax on line 15c of Computation A to page 1, line 7 of the

Interest received while a nonresident is not taxable.

resident return. Insert the words "Schedule L" to the left of the tax amount

to indicate the tax was transferred from a Schedule L.

LINE 8 - DIVIDEND INCOME

Dividends received while a resident are taxable and must be entered in

NEGATIVE TAX

column 1. Dividends received while a nonresident are not taxable.

If taxpayer is a resident at tax year end and line 12, column 1, is a loss,

multiply the loss by the tax rate for line 15a (resident rate) of computation (A

LINE 9a - BUSINESS, PROFESSIONAL AND FARM

or B) you are using and enter this amount on line 15a. If taxpayer is a

INCOME

nonresident at tax year end and line 12, column 1 is a loss, multiply the loss

Business, professional and farm income earned while a resident of Walker

by the tax rate for line 15b (nonresident rate) of the computation (A or B) you

is taxable regardless of where the business or profession is conducted.

are using and enter this amount on line 15a. If line 12, column 2, is a loss,

Nonresident business, professional and farm income earned in Walker is

multiply the loss by the tax rate for line 15b (nonresident rate) of

taxable. See the instructions for the nonresident return to determine the

computation (A or B) and enter this amount on line 15b. Indicate negative

amount of this income to report.

totals by putting them in parenthesis ( ).

The KEOGH, SEP or SIMPLE retirement deduction is subtracted from

If combining lines 15a and 15b results in tax due the tax due must be

business, professional and farm income prior to the income being entered

entered on line 15c Schedule L, and line 7 of the resident return. However, if

on line 9a. This deduction must be allocated between resident and

combining lines 15a and 15b results in a negative tax, enter zero on line 15c

nonresident status in the same manner as income.

ATTACH

of Schedule L and on line 7 of the resident return.

SUPPORTING SCHEDULES DETAILING COMPUTATION OF THIS

DEDUCTION.

COMPLETION OF RESIDENT RETURN W-1040R

LINE 9b - GAIN OR LOSS FROM THE SALE OR

Schedule L is not a return. It must be attached to a resident return. After

EXCHANGE OF PROPERTY

entering your tax on line 7 of the resident return, follow the resident return

instructions to complete the remainder of the return.

Residency status on the date the sale or exchange of property took place

determines whether the sale or exchange is considered a transaction by a

resident or a nonresident.

Rev. 8/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1