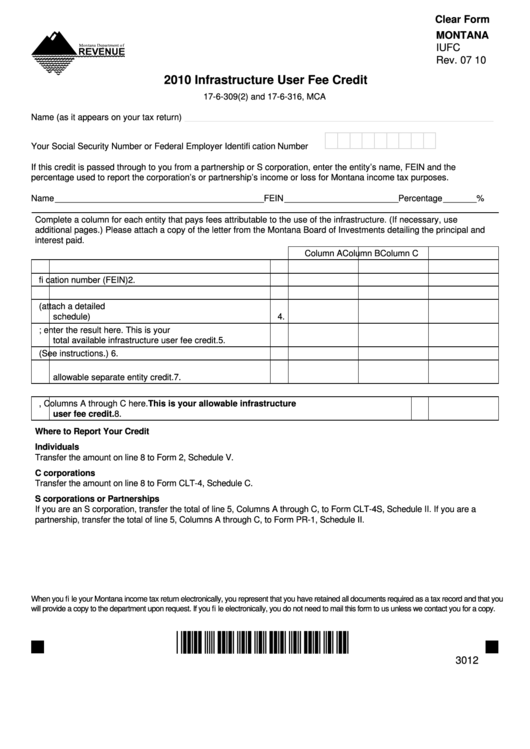

Clear Form

MONTANA

IUFC

Rev. 07 10

2010 Infrastructure User Fee Credit

17-6-309(2) and 17-6-316, MCA

Name (as it appears on your tax return)

_________________________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and the

percentage used to report the corporation’s or partnership’s income or loss for Montana income tax purposes.

Name ____________________________________________ FEIN ________________________ Percentage _______ %

Complete a column for each entity that pays fees attributable to the use of the infrastructure. (If necessary, use

additional pages.) Please attach a copy of the letter from the Montana Board of Investments detailing the principal and

interest paid.

Column A

Column B

Column C

1. Entity name

1.

2. Federal employer identifi cation number (FEIN)

2.

3. Current year infrastructure user fee credit

3.

4. Credit carryforward/carryback (attach a detailed

schedule)

4.

5. Add lines 3 and 4; enter the result here. This is your

total available infrastructure user fee credit.

5.

6. Montana tax liability. (See instructions.)

6.

7. Enter the lesser of line 5 or line 6 here. This is your

allowable separate entity credit.

7.

8. Enter the total of line 7, Columns A through C here. This is your allowable infrastructure

user fee credit.

8.

Where to Report Your Credit

Individuals

Transfer the amount on line 8 to Form 2, Schedule V.

C corporations

Transfer the amount on line 8 to Form CLT-4, Schedule C.

S corporations or Partnerships

If you are an S corporation, transfer the total of line 5, Columns A through C, to Form CLT-4S, Schedule II. If you are a

partnership, transfer the total of line 5, Columns A through C, to Form PR-1, Schedule II.

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required as a tax record and that you

will provide a copy to the department upon request. If you fi le electronically, you do not need to mail this form to us unless we contact you for a copy.

*30120101*

3012

1

1