Sales And Use Tax Return Form - City Of Englewood, Colorado

ADVERTISEMENT

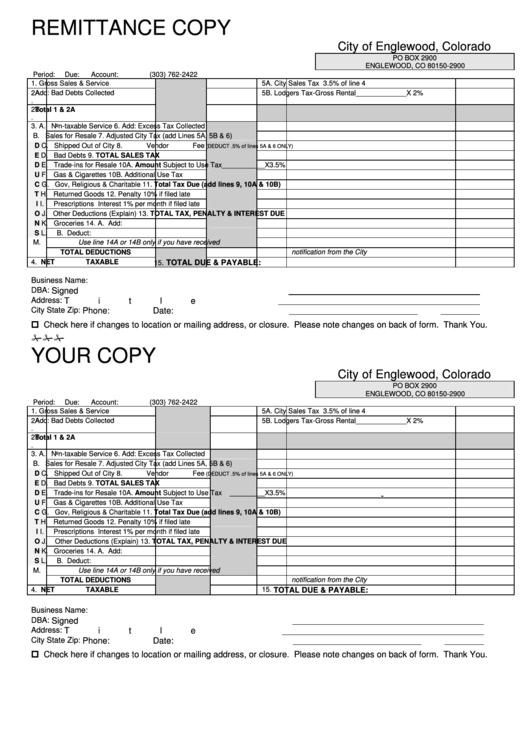

REMITTANCE COPY

City of Englewood, Colorado

PO BOX 2900

ENGLEWOOD, CO 80150-2900

Period:

Due:

Account:

(303) 762-2422

1.

Gross Sales & Service

5A.

City Sales Tax 3.5% of line 4

2A

Add: Bad Debts Collected

5B.

Lodgers Tax-Gross Rental_____________X 2%

.

2B

Total 1 & 2A

.

3.

A. Non-taxable Service

6.

Add: Excess Tax Collected

B. Sales for Resale

7.

Adjusted City Tax (add Lines 5A, 5B & 6)

D

C. Shipped Out of City

8.

Vendor Fee

(DEDUCT .5% of lines 5A & 6 ONLY)

E

D. Bad Debts

9.

TOTAL SALES TAX

D

E. Trade-ins for Resale

10A.

Amount Subject to Use Tax___________X3.5%

U

F. Gas & Cigarettes

10B.

Additional Use Tax

G. Gov, Religious & Charitable

11.

C

Total Tax Due (add lines 9, 10A & 10B)

H. Returned Goods

12.

Penalty 10% if filed late

T

I.

Prescriptions

Interest 1% per month if filed late

I

O

J. Other Deductions (Explain)

13.

TOTAL TAX, PENALTY & INTEREST DUE

N

K. Groceries

14.

A. Add:

S

L.

B. Deduct:

M.

Use line 14A or 14B only if you have received

notification from the City

TOTAL DEDUCTIONS

4.

NET TAXABLE

.

TOTAL DUE & PAYABLE:

15

Business Name:

DBA:

Signed

Address:

Title

City State Zip:

Phone:

Date:

Check here if changes to location or mailing address, or closure. Please note changes on back of form. Thank You.

....................

.......................Cut Here ..........................

.....................Cut Here ................

........................Cut Here

YOUR COPY

City of Englewood, Colorado

PO BOX 2900

ENGLEWOOD, CO 80150-2900

Period:

Due:

Account:

(303) 762-2422

1.

Gross Sales & Service

5A.

City Sales Tax 3.5% of line 4

2A

Add: Bad Debts Collected

5B.

Lodgers Tax-Gross Rental_____________X 2%

.

2B

Total 1 & 2A

.

3.

A. Non-taxable Service

6.

Add: Excess Tax Collected

B. Sales for Resale

7.

Adjusted City Tax (add Lines 5A, 5B & 6)

D

C. Shipped Out of City

8.

Vendor Fee

(DEDUCT .5% of lines 5A & 6 ONLY)

E

D. Bad Debts

9.

TOTAL SALES TAX

D

E. Trade-ins for Resale

10A.

Amount Subject to Use Tax

_________X3.5%

F. Gas & Cigarettes

10B.

Additional Use Tax

U

G. Gov, Religious & Charitable

11.

C

Total Tax Due (add lines 9, 10A & 10B)

T

H. Returned Goods

12.

Penalty 10% if filed late

I

I.

Prescriptions

Interest 1% per month if filed late

O

J.

Other Deductions (Explain)

13.

TOTAL TAX, PENALTY & INTEREST DUE

N

K. Groceries

14.

A. Add:

S

L.

B. Deduct:

M.

Use line 14A or 14B only if you have received

notification from the City

TOTAL DEDUCTIONS

4.

NET TAXABLE

15.

TOTAL DUE & PAYABLE:

Business Name:

DBA:

Signed

Address:

Title

City State Zip:

Phone:

Date:

Check here if changes to location or mailing address, or closure. Please note changes on back of form. Thank You.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1