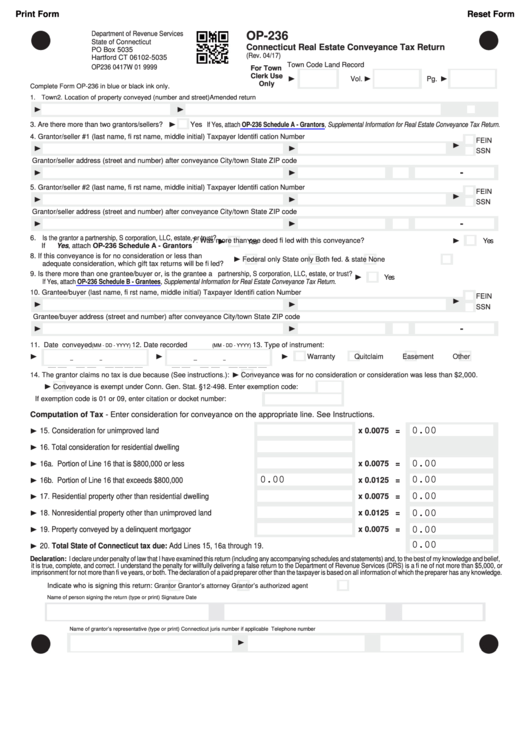

Print Form

Reset Form

Department of Revenue Services

OP-236

State of Connecticut

Connecticut Real Estate Conveyance Tax Return

PO Box 5035

(Rev. 04/17)

Hartford CT 06102-5035

Town Code

Land Record

OP236 0417W 01 9999

For Town

Clerk Use

Vol.

Pg.

Only

Complete Form OP-236 in blue or black ink only.

1. Town

2. Location of property conveyed (number and street)

Amended return

______________________________

3. Are there more than two grantors/sellers?

Yes If Yes, attach OP-236 Schedule A - Grantors, Supplemental Information for Real Estate Conveyance Tax Return.

4. Grantor/seller #1 (last name, fi rst name, middle initial)

Taxpayer Identifi cation Number

FEIN

SSN

Grantor/seller address (street and number) after conveyance

City/town

State ZIP code

-

5. Grantor/seller #2 (last name, fi rst name, middle initial)

Taxpayer Identifi cation Number

FEIN

SSN

Grantor/seller address (street and number) after conveyance

City/town

State ZIP code

-

6. Is the grantor a partnership, S corporation, LLC, estate, or trust?

7. Was more than one deed fi led with this conveyance?

Yes

Yes

If Yes, attach OP-236 Schedule A - Grantors

8. If this conveyance is for no consideration or less than

Federal only

State only

Both fed. & state

None

adequate consideration, which gift tax returns will be fi led?

9. Is there more than one grantee/buyer or, is the grantee a partnership, S corporation, LLC, estate, or trust?

Yes

_______________________________

If Yes, attach OP-236 Schedule B - Grantees, Supplemental Information for Real Estate Conveyance Tax Return.

10. Grantee/buyer (last name, fi rst name, middle initial)

Taxpayer Identifi cation Number

FEIN

SSN

Grantee/buyer address (street and number) after conveyance

City/town

State ZIP code

-

11. Date conveyed

12. Date recorded

13. Type of instrument:

(MM - DD - YYYY)

(MM - DD - YYYY)

Warranty

Quitclaim

Easement

Other

14. The grantor claims no tax is due because (See instructions.):

Conveyance was for no consideration or consideration was less than $2,000.

Conveyance is exempt under Conn. Gen. Stat. §12-498. Enter exemption code:

If exemption code is 01 or 09, enter citation or docket number:

Computation of Tax - Enter consideration for conveyance on the appropriate line. See Instructions.

0.00

15. Consideration for unimproved land

x 0.0075 =

16. Total consideration for residential dwelling

0.00

16a. Portion of Line 16 that is $800,000 or less

x 0.0075 =

0.00

0.00

16b. Portion of Line 16 that exceeds $800,000

x 0.0125 =

0.00

17. Residential property other than residential dwelling

x 0.0075 =

0.00

18. Nonresidential property other than unimproved land

x 0.0125 =

0.00

19. Property conveyed by a delinquent mortgagor

x 0.0075 =

0.00

20. Total State of Connecticut tax due: Add Lines 15, 16a through 19.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief,

it is true, complete, and correct. I understand the penalty for willfully delivering a false return to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, or

imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Indicate who is signing this return:

Grantor

Grantor’s attorney

Grantor’s authorized agent

Name of person signing the return (type or print)

Signature

Date

Name of grantor’s representative (type or print)

Connecticut juris number if applicable

Telephone number

1

1 2

2 3

3 4

4