Publication 553 - Highlights Of 2003 Tax Changes - Department Of The Treasury Page 5

ADVERTISEMENT

serve on qualified official extended duty as a member of

Years eligible for tax forgiveness (page 2). For astro-

the uniformed services or Foreign Service of the United

nauts who die in the line of duty, income tax is forgiven for

States.

the year of death and the previous year. For the crew of the

space shuttle Columbia, income tax is forgiven for 2002

Claiming a refund for a prior year home sale. This

and 2003.

choice applies to any sale of a main home after May 6,

1997, so you may be able to claim a refund if you paid tax

Worksheet A (page 3) and Worksheet B (page 4).

on a gain from a sale after that date. Generally, you must

Use Worksheet A or B in Publication 3920 to figure the

file a claim for credit or refund within 3 years from the date

income tax to be forgiven. When filling out columns (A) and

you filed your original return or within 2 years from the date

(B) of Worksheet A or B for a crew member of the space

you paid the tax, whichever is later. However, the deadline

shuttle Columbia, enter the amounts for 2002 and 2003,

to file this claim for 1997, 1998, 1999, or 2000 has been

respectively. Leave column (C) blank.

extended to November 10, 2004.

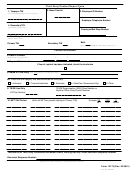

Line 2 of Worksheet A and line 3 of Worksheet B require

More information. For details, see Publication 523,

an entry for the decedent’s total tax. The total tax lines for

Selling Your Home.

2002 and 2003 returns are listed in the following table.

Student at U.S. military academy. Beginning in 2003,

Form

2002

2003

the 10% additional tax on taxable distributions from a

1040

Line 61

Line 60

Coverdell education savings account (ESA) or qualified

tuition program (QTP) does not apply to distributions made

1040A

Line 38

on account of the attendance of the designated beneficiary

1040EZ

Line 10

at a U.S. military academy. This applies to students at the

File Form 1040

U.S. Military Academy, the U.S. Naval Academy, the U.S.

TeleFile Tax

Line K

Air Force Academy, the U.S. Coast Guard Academy, and

Record

the U.S. Merchant Marine Academy. This exception ap-

1040NR

Line 57

Line 56

plies only to the amount of the distribution that does not

exceed the costs of advanced education (as defined in title

File Form

1040NR – EZ

Line 17

10 of the U.S. Code) attributable to such attendance. For

1040NR

more information about the additional tax on distributions,

see chapters 7 (Coverdell ESA) and 8 (QTP) in Publication

Nonqualifying income (page 5). For an astronaut, the

970, Tax Benefits for Education.

second bullet should read “Amounts that would not have

Armed Forces reservists. Beginning in 2003, if you are a

been payable but for an action taken after the date the

member of a reserve component of the Armed Forces of

astronaut died.”

the United States, you may be able to deduct some of your

How to complete the returns (page 7). Write “Astro-

reserve-related travel costs as an adjustment to gross

naut killed in the line of duty” across the top of page 1 of

income rather than as an itemized deduction. For more

each return.

information, see Armed Forces Reservists Traveling More

Than 100 Miles From Home in chapter 6 of Publication

Designated private delivery services (page 8). Two

463, Travel, Entertainment, Gift, and Car Expenses.

private delivery services have been added to the list. They

are:

Astronauts Who Die

•

FedEx International Priority.

in the Line of Duty

•

FedEx International First.

Three tax relief provisions are extended to astronauts who

die in the line of duty after 2002 (including the crew of the

Death benefits (page 9). Beginning in 2003, payments

space shuttle Columbia) and their survivors. These provi-

received by an individual or an estate from the employer of

sions are discussed on the following pages of Publication

an astronaut as a result of death in the line of duty are not

3920, Tax Relief for Victims of Terrorist Attacks.

included in income as explained in Publication 3920.

1) Pages 2 –8: Tax Forgiveness.

Estate tax reduction (page 10). For decedents dying in

2) Page 9: Death Benefits.

2003, Form 706 , United States Estate (and Generation-

Skipping Transfers) Tax Return (revised August 2003)

3) Page 10: Estate Tax Reduction.

must be filed by the executor for the estate of every U.S.

However, the above discussions should be modified for

citizen or resident whose gross estate, plus adjusted tax-

astronauts. The following paragraphs explain these modifi-

able gifts and specific exemption, is more than $1,000,000.

cations. Read these paragraphs in conjunction with the

However, rather than using the Unified Rate Schedule in

corresponding discussions in Publication 3920.

the August 2003 instructions for Form 706, the executor

can choose to compute the tax on the astronaut’s estate

Tax forgiveness (pages 2 –8). The following paragraphs

using the rate schedule on page 25 of the November 2001

modify the tax forgiveness rules for astronauts who die in

the line of duty after 2002.

revision of the instructions for Form 706. If the executor

Chapter 1 Tax Changes for Individuals

Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23