Publication 553 - Highlights Of 2003 Tax Changes - Department Of The Treasury Page 2

ADVERTISEMENT

•

To adjust your....

Get Form...

And Publication...

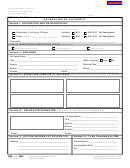

The 15% tax rate bracket for married taxpayers filing

jointly and qualifying widow(er) is expanded.

Withholding

W – 4, Employee’s

919, How Do I

•

The 27%, 30%, 35%, and 38.6% tax rates are re-

Withholding

Adjust My Tax

Allowance

Withholding?

duced to 25%, 28%, 33%, and 35%, respectively.

Certificate

Estimated tax

1040 – ES,

505, Tax

Lower Maximum Tax

payments

Estimated Tax for

Withholding and

Individuals

Estimated Tax

Rates on Net Capital Gain

For sales and other dispositions of property after May 5,

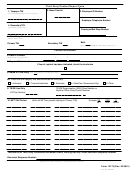

Photographs of missing children. The Internal Reve-

2003 (including installment payments received after that

nue Service is a proud partner with the National Center for

date), the maximum tax rates on net capital gain have

Missing and Exploited Children. Photographs of missing

changed as follows.

children selected by the Center may appear in this publica-

•

The 20% and 10% tax rates have been lowered to

tion on pages that would otherwise be blank. You can help

15% and 5%, respectively.

bring these children home by looking at the photographs

•

and calling 1– 800 – THE –LOST (1 –800 – 843 –5678) if

The 8% tax rate for qualified 5-year gain has been

you recognize a child.

eliminated. Instead, the new 5% rate applies to gain

that would have qualified for the 8% rate.

Comments and suggestions. We welcome your com-

ments about this publication and your suggestions for

There is no change to the maximum tax rates that apply

future editions.

to collectibles gain, gain on qualified small business stock,

You can e-mail us at *taxforms@irs.gov. Please put

and unrecaptured section 1250 gain.

“Publications Comment” on the subject line.

Elimination of 18% rate. In 2006, the 20% rate was

You can write to us at the following address:

scheduled to be lowered to 18% for qualified 5-year gain

from property with a holding period that began after 2000.

Internal Revenue Service

The 18% rate and the 5-year holding period have been

Individual Forms and Publications Branch

eliminated. Instead, the new 15% rate applies to gain that

SE:W:CAR:MP:T:I

would have qualified for the 18% rate.

1111 Constitution Ave. NW

Taxpayers who owned certain assets on January 1,

Washington, DC 20224

2001, could have elected to treat those assets as sold and

repurchased on the same date, if they paid tax for 2001 on

We respond to many letters by telephone. Therefore, it

any resulting gain. The purpose of the election was to

would be helpful if you would include your daytime phone

make any future gain on the asset eligible for the 18% rate.

number, including the area code, in your correspondence.

That election is irrevocable. Thus, if you made the election,

you may not amend your 2001 income tax return to get a

refund of the tax you paid on the resulting gain.

More information. For more information, see Capital

Gain Tax Rates in chapter 4 of Publication 550, Investment

1.

Income and Expenses.

Tax Changes

Dividends Taxed at Capital Gain Rate

for Individuals

Beginning in 2003, qualified dividends are subject to the

5% or 15% maximum tax rate that applies to net capital

gain. Qualified dividends should be shown in box 1b of the

Forms 1099 – DIV or similar statements you receive.

2003 Changes

Before 2003, all ordinary dividends were taxed at the

higher rates that applied to ordinary income.

If you have qualified dividends, you must figure your tax

Tax Rate Changes

by completing either Schedule D (Form 1040) or the Quali-

fied Dividends and Capital Gain Tax Worksheet in the

The following list highlights the changes to the tax rates

Form 1040 or 1040A instructions.

that are effective for 2003. The tax tables and tax rate

For more information, see Qualified Dividends in chap-

schedules that reflect the changes are included in your tax

ter 1 of Publication 550, Investment Income and Expenses.

form instruction booklet.

Investment interest deducted. If you claim a deduction

•

The 10% tax rate bracket for most filing statuses is

for investment interest, you must reduce the amount of

expanded. This means that more of your income will

your qualified dividends that are eligible for the 5% or 15%

be taxed at 10% instead of a higher rate.

tax rate by the amount of qualified dividends you choose to

Page 2

Chapter 1 Tax Changes for Individuals

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23