Publication 553 - Highlights Of 2003 Tax Changes - Department Of The Treasury Page 18

ADVERTISEMENT

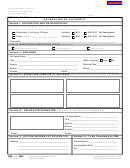

Maximum Estate and

6.

Gift Tax Rate Reduced

For estates of decedents dying, and gifts made, after 2002,

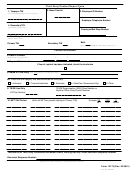

Excise Taxes

the maximum rate for the estate tax and the gift tax is as

follows.

Maximum

2004 Change

Year

Tax Rate

2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

49%

2004 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

48%

Air Transportation Taxes

2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

47%

2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

46%

2007, 2008, and 2009 . . . . . . . . . . . . . . . . . .

45%

For amounts paid in 2004, the tax on the use of interna-

tional air travel facilities will be $13.70 per person for flights

that begin or end in the United States, or $6.90 per person

Credit for State

for domestic segments that begin or end in Alaska or

Death Taxes Reduced

Hawaii (applies only to departures). See Publication 510,

Excise Taxes for 2004, for information on air transportation

For estates of decedents dying in 2003, the credit allowed

taxes.

for state death taxes is limited to 50% of the amount that

would otherwise be allowed. For estates of decedents

dying in 2004, the credit will be limited to 25%.

For estates of decedents dying after 2004, the state

7.

death tax credit will be replaced with a deduction for state

death taxes.

Foreign Issues

Generation-Skipping Transfer

(GST) Exemption Increased

2003 Change

The generation-skipping transfer (GST) lifetime exemption

increased to $1,120,000. The annual increase can only be

allocated to transfers made during or after the year of the

increase.

New Requirement for Form W–7

Form 709–A Obsolete

If you are a resident or nonresident alien applying for an

individual taxpayer identification number (ITIN) to file a tax

Form 709 – A, United States Short Form Gift Return, has

return, you now must attach your original, completed tax

been obsoleted. All gift tax returns must now be filed on

return to Form W –7. For more information, see Form

Form 709, United States Gift (and Generation-Skipping

W–7, Application for IRS Individual Taxpayer Identification

Transfer) Tax Return.

Number.

2004 Change

Qualified Family-Owned Business

Interest Deduction Repealed

The qualified family-owned business interest deduction

has been repealed for the estates of decedents dying after

December 31, 2003.

Page 18

Chapter 7 Foreign Issues

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23