Publication 553 - Highlights Of 2003 Tax Changes - Department Of The Treasury Page 10

ADVERTISEMENT

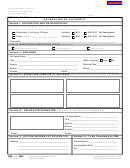

HDHP, you can ask the trustee of your HSA to send you a

The amount at which the phaseout begins depends on

distribution from your HSA.

your filing status. For 2004, the phaseout begins at

$107,025 for married persons filing separately, $142,700

Qualified medical expenses. Qualified medical ex-

for single individuals, $178,350 for heads of household,

penses are those that qualify for the medical and dental

and $214,050 for married persons filing jointly and qualify-

expenses deduction. These are explained in Publication

ing widow(er)s with a dependent child.

502, Medical and Dental Expenses. Examples include

amounts paid for doctors’ fees, prescription and non-pre-

Electric and Clean-Fuel Vehicles

scription medicines, and necessary hospital services not

paid for by insurance. Qualified medical expenses must be

For vehicles placed in service in 2004, the maximum

incurred after the HSA has been established.

clean-fuel vehicle deduction and qualified electric vehicle

You cannot deduct qualified medical expenses as

credit are scheduled to be reduced by 25%, as compared

!

an itemized deduction on Schedule A (Form

to 2003.

1040) that are equal to the tax-free amount of the

CAUTION

At the time this publication was issued, Congress

distribution from your HSA.

!

was considering legislation that would repeal the

reduction for 2004. See What’s Hot in Tax

Special rules for insurance premiums. Generally,

CAUTION

Forms, Pubs, and Other Tax Products at

you cannot treat insurance premiums as qualified medical

formspubs/index.html to find out if this legislation was

expenses for HSAs. You can, however, treat premiums for

enacted.

long-term care coverage, health care coverage while you

receive unemployment benefits, or health care continua-

tion coverage required under any federal law as qualified

Standard Mileage Rate

medical expenses for HSAs. If you are age 65 or older, you

can treat insurance premiums (other than premiums for a

Business-related mileage. For 2004, the standard mile-

Medicare supplemental policy, such as Medigap) as quali-

age rate for the cost of operating your car, van, pickup, or

fied medical expenses for HSAs.

panel truck increases from 36 cents a mile to 37

1

/

cents a

2

Recordkeeping. For each qualified medical ex-

mile for all business miles.

pense you deduct as an itemized deduction on

Car expenses and use of the standard mileage rate are

Schedule A or pay with a distribution from your

RECORDS

explained in chapter 4 of Publication 463, Travel, Enter-

HSA, you must keep a record of the name and address of

tainment, Gift, and Car Expenses.

each person you paid and the amount and date of the

Medical- and move-related mileage. For 2004, the stan-

payment. Do not send these records with your tax return.

dard mileage rate for the cost of operating your car for

Keep them with your tax records.

medical reasons or as part of a deductible move is in-

creased from 12 cents a mile to 14 cents a mile. See

More Information

Transportation under What Medical Expenses Are Deduct-

ible in Publication 502, Medical and Dental Expenses, or

The Internal Revenue Service issued further guidance on

Travel by car under Deductible Moving Expenses in Publi-

setting up an HSA in Notice 2004 – 2. The notice can be

cation 521, Moving Expenses.

found in Internal Revenue Bulletin 2004 –2.

Depreciation and

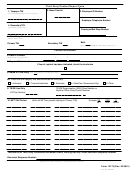

Standard Deduction

Section 179 Expense

Amount Increases

Extension of acquisition date. Property will meet the

The standard deduction for taxpayers who do not itemize

“acquisition date test” for purposes of qualifying for the

deductions on Schedule A of Form 1040 is, in most cases,

30% special depreciation allowance (see chapter 3 of

higher for 2004 than it was for 2003. The amount depends

Publication 946, How To Depreciate Property) if the prop-

on your filing status, whether you are 65 or older or blind,

erty is acquired before January 1, 2005 (extended from

and whether an exemption can be claimed for you by

September 11, 2004).

another taxpayer. The 2004 Standard Deduction Tables

are shown in Publication 505, Tax Withholding and Esti-

Increased section 179 limits. The maximum section 179

mated Tax.

deduction you can elect for property you place in service in

2004 is increased from $100,000 to $102,000 for qualified

Exemption Amount Increases

section 179 property ($137,000 for qualified zone property,

qualified renewal property, or qualified New York Liberty

The amount you can deduct for each exemption increases

Zone property). This limit is reduced by the amount by

from $3,050 in 2003 to $3,100 in 2004.

which the cost of section 179 property placed in service

You lose all or part of the benefit of your exemptions if

during the tax year exceeds $410,000 (increased from

your adjusted gross income is above a certain amount.

$400,000). See chapter 2 of Publication 946.

Page 10

Chapter 1 Tax Changes for Individuals

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23