Form Cf-1065 - Draft - Partnership Common Form - 2013

ADVERTISEMENT

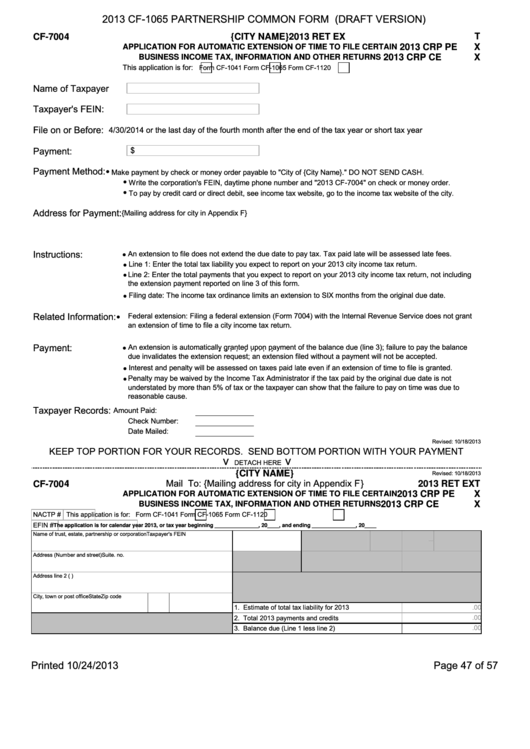

2013 CF-1065 PARTNERSHIP COMMON FORM (DRAFT VERSION)

{CITY NAME}

2013 RET EXT

CF-7004

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE CERTAIN

2013 CRP PEX

2013 CRP CEX

BUSINESS INCOME TAX, INFORMATION AND OTHER RETURNS

This application is for:

Form CF-1041

Form CF-1065

Form CF-1120

Name of Taxpayer

Taxpayer's FEIN:

File on or Before:

4/30/2014 or the last day of the fourth month after the end of the tax year or short tax year

Payment:

$

Payment Method:

•

Make payment by check or money order payable to "City of {City Name}." DO NOT SEND CASH.

•

Write the corporation's FEIN, daytime phone number and "2013 CF-7004" on check or money order.

•

To pay by credit card or direct debit, see income tax website, go to the income tax website of the city.

Address for Payment:

{Mailing address for city in Appendix F}

Instructions:

An extension to file does not extend the due date to pay tax. Tax paid late will be assessed late fees.

•

Line 1: Enter the total tax liability you expect to report on your 2013 city income tax return.

•

Line 2: Enter the total payments that you expect to report on your 2013 city income tax return, not including

•

the extension payment reported on line 3 of this form.

Filing date: The income tax ordinance limits an extension to SIX months from the original due date.

•

Related Information: •

Federal extension: Filing a federal extension (Form 7004) with the Internal Revenue Service does not grant

an extension of time to file a city income tax return.

Payment:

Payment:

An extension is automatically granted upon payment of the balance due (line 3); failure to pay the balance

y g

p

p y

(

);

p y

•

due invalidates the extension request; an extension filed without a payment will not be accepted.

Interest and penalty will be assessed on taxes paid late even if an extension of time to file is granted.

•

Penalty may be waived by the Income Tax Administrator if the tax paid by the original due date is not

•

understated by more than 5% of tax or the taxpayer can show that the failure to pay on time was due to

reasonable cause.

Taxpayer Records:

Amount Paid:

Check Number:

Date Mailed:

Revised: 10/18/2013

KEEP TOP PORTION FOR YOUR RECORDS. SEND BOTTOM PORTION WITH YOUR PAYMENT

v

v

DETACH HERE

{CITY NAME}

Revised: 10/18/2013

Mail To: {Mailing address for city in Appendix F}

CF-7004

2013 RET EXT

2013 CRP PEX

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE CERTAIN

2013 CRP CEX

BUSINESS INCOME TAX, INFORMATION AND OTHER RETURNS

NACTP #

This application is for:

Form CF-1041

Form CF-1065

Form CF-1120

EFIN #

The application is for calendar year 2013, or tax year beginning _______________, 20____, and ending _______________, 20____

Name of trust, estate, partnership or corporation

Taxpayer's FEIN

Address (Number and street)

Suite. no.

Address line 2 (P.O. Box address for mailing use only)

City, town or post office

State

Zip code

1. Estimate of total tax liability for 2013

.00

.00

2. Total 2013 payments and credits

.00

3. Balance due (Line 1 less line 2)

Printed 10/24/2013

Page 47 of 57

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1