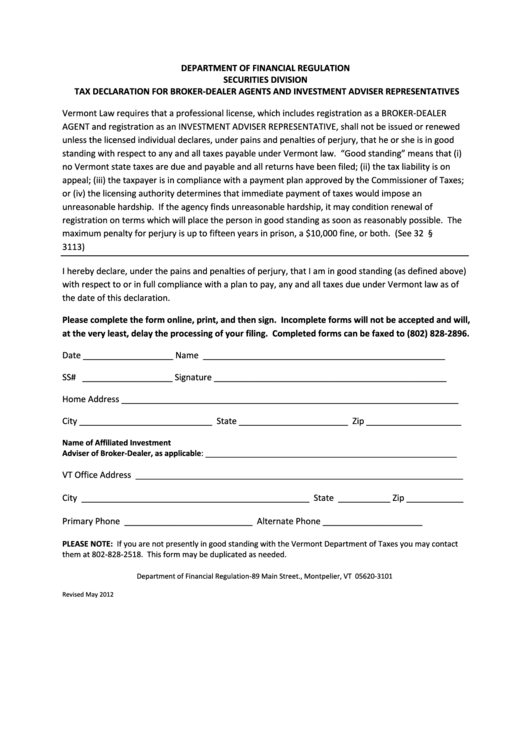

DEPARTMENT OF FINANCIAL REGULATION

SECURITIES DIVISION

TAX DECLARATION FOR BROKER-DEALER AGENTS AND INVESTMENT ADVISER REPRESENTATIVES

Vermont Law requires that a professional license, which includes registration as a BROKER-DEALER

AGENT and registration as an INVESTMENT ADVISER REPRESENTATIVE, shall not be issued or renewed

unless the licensed individual declares, under pains and penalties of perjury, that he or she is in good

standing with respect to any and all taxes payable under Vermont law. “Good standing” means that (i)

no Vermont state taxes are due and payable and all returns have been filed; (ii) the tax liability is on

appeal; (iii) the taxpayer is in compliance with a payment plan approved by the Commissioner of Taxes;

or (iv) the licensing authority determines that immediate payment of taxes would impose an

unreasonable hardship. If the agency finds unreasonable hardship, it may condition renewal of

registration on terms which will place the person in good standing as soon as reasonably possible. The

maximum penalty for perjury is up to fifteen years in prison, a $10,000 fine, or both. (See 32 V.S.A. §

3113)

I hereby declare, under the pains and penalties of perjury, that I am in good standing (as defined above)

with respect to or in full compliance with a plan to pay, any and all taxes due under Vermont law as of

the date of this declaration.

Please complete the form online, print, and then sign. Incomplete forms will not be accepted and will,

at the very least, delay the processing of your filing. Completed forms can be faxed to (802) 828-2896.

Date ___________________

Name ___________________________________________________

SS# ___________________

Signature _________________________________________________

Home Address _______________________________________________________________________

City ____________________________ State _______________________ Zip ____________________

Name of Affiliated Investment

Adviser of Broker-Dealer, as applicable: ___________________________________________________________

VT Office Address _____________________________________________________________________

City ________________________________________________ State ___________ Zip ____________

Primary Phone ___________________________ Alternate Phone _____________________

PLEASE NOTE: If you are not presently in good standing with the Vermont Department of Taxes you may contact

them at 802-828-2518. This form may be duplicated as needed.

Department of Financial Regulation-89 Main Street., Montpelier, VT 05620-3101

Revised May 2012

1

1