Individual Income Tax Return - Village Of Westfield Center,ohio

ADVERTISEMENT

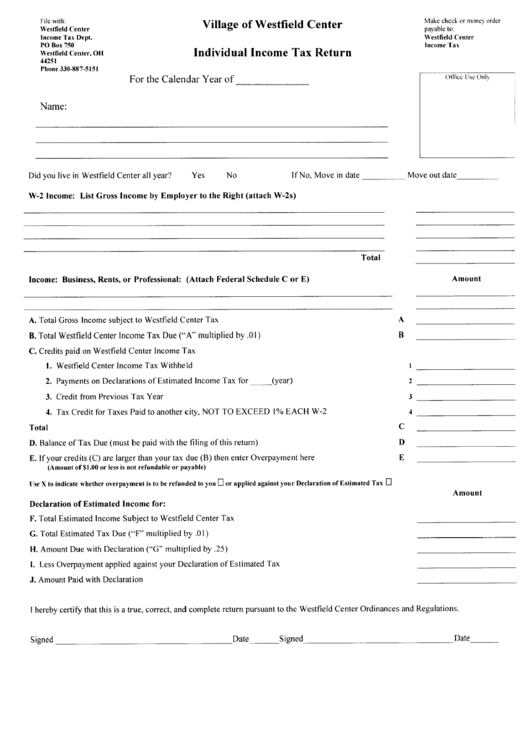

File with:

Westfield Center

Income Tax Dept.

PO Box 750

Westfield Center, OH

44251

Phone 330-887-5151

Name:

Village of Westfield Center

Individual Income Tax Return

For the Calendar Year of

Make check or money order

payable to:

Westfield Center

Income Tax

Office Use Only

Did you live in Westfield Center all year?

Yes

No

If No, Move in date

VV-2 Income: List Gross Income by Employer to the Right (attach W-2s)

Move out date

Total

Income: Business, Rents, or Professional: (Attach Federal Schedule C or E)

A. Total Gross Income subject to Westfield Center Tax

B. Total Westfield Center Income Tax Due ("A" multiplied by .01)

C. Credits paid on Westfield Center Income Tax

1. Westfield Center Income Tax Withheld

2. Payments on Declarations of Estimated Income Tax for

(year)

3. Credit from Previous Tax Year

A

B

4. Tax Credit for Taxes Paid to another city, NOT TO EXCEED 1% EACH W-2

Total

D. Balance of Tax Due (must be paid with the filing of this return)

E. If your credits (C) are larger than your tax due (B) then enter Overpayment here

(Amount of $1.00 or less is not refundable or payable)

I'se Xtoindicate whether overpayment istobe refunded toyou D or applied against your Declaration ofEstimated Tax D

Declaration of Estimated Income for:

F. Total Estimated Income Subject to Westfield Center Tax

G. Total Estimated Tax Due ("F" multiplied by .01)

H. Amount Due with Declaration ("G" multiplied by .25)

I. Less Overpayment applied against your Declaration of Estimated Tax

J. Amount Paid with Declaration

C

D

E

Amount

Amount

I hereby certify thatthis is a true, correct, and complete return pursuant to the Westfield Center Ordinances and Regulations.

Signed

Date

Signed

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1