Form 01 - Declaration Of Estimated Income Tax - City Of Warren

ADVERTISEMENT

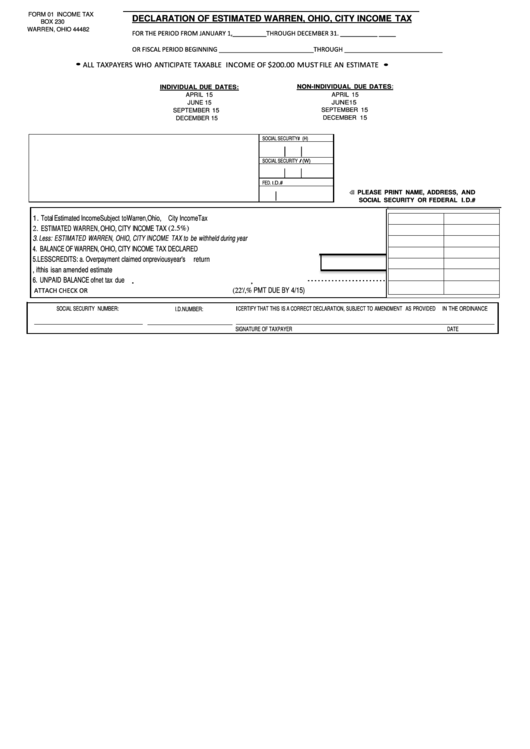

FORM 01 INCOME TAX

DECLARATION OF ESTIMATED WARREN, OHIO, CITY INCOME TAX

P.O. BOX 230

WARREN, OHIO 44482

FOR THE PERIOD FROM JANUARY 1,__________THROUGH DECEMBER 31. ___________ _____

OR FISCAL PERIOD BEGINNING ____________________________THROUGH _____________________________

• ALL TAXPAYERS WHO ANTICIPATE TAXABLE INCOME OF $200.00 MUST FILE AN ESTIMATE •

NON-INDIVIDUAL DUE DATES:

INDIVIDUAL DUE DATES:

APRIL 15

APRIL 15

JUNE15

JUNE 15

SEPTEMBER 15

SEPTEMBER 15

DECEMBER 15

DECEMBER 15

SOCIAL SECURITY# (H)

I

I

SOCIAL SECURITY

(W)

I

I

I

FED.

D.#

I.

<Ill PLEASE PRINT NAME, ADDRESS, AND

I

SOCIAL SECURITY OR FEDERAL I.D.#

..................................................

1. Total Estimated Income Subject to Warren, Ohio, City Income Tax

2. ESTIMATED WARREN, OHIO, CITY INCOME TAX (2.5%)

3. Less: ESTIMATED WARREN, OHIO, CITY INCOME TAX to be withheld during year ......................................

4. BALANCE OF WARREN, OHIO, CITY INCOME TAX DECLARED

I

5. LESS CREDITS: a. Overpayment claimed on previous year's return

b. Previous payments, if this is an amended estimate .......................................

....................................

6. UNPAID BALANCE of net tax due

................ ·······················

,

......................

ATTACH CHECK OR M.D. FOR AMOUNT DUE WITH THIS DECLARATION

(22'/,% PMT DUE BY 4/15)

SOCIAL SECURITY NUMBER:

I CERTIFY THAT THIS IS A CORRECT DECLARATION, SUBJECT TO AMENDMENT AS PROVIDED IN THE ORDINANCE

I.D.NUMBER:

SIGNATURE OF TAXPAYER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1