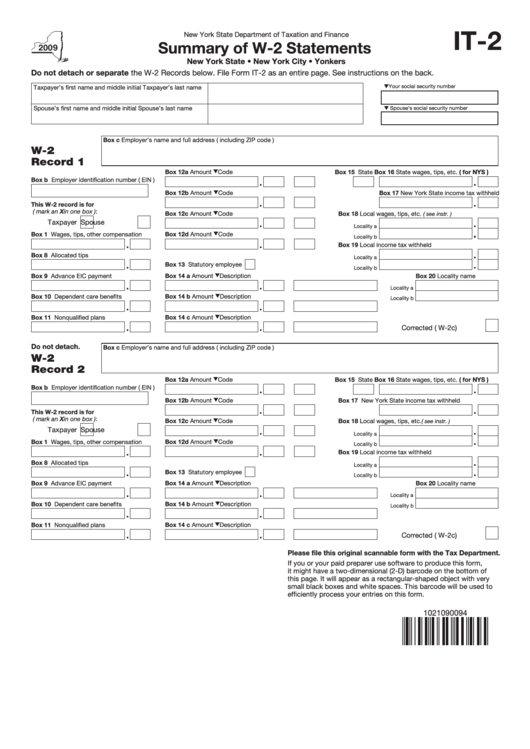

IT-2

New York State Department of Taxation and Finance

Summary of W-2 Statements

New York State • New York City • Yonkers

Do not detach or separate the W-2 Records below. File Form IT-2 as an entire page. See instructions on the back.

Taxpayer’s first name and middle initial

Taxpayer’s last name

Your social security number

Spouse’s first name and middle initial

Spouse’s last name

Spouse’s social security number

Box c Employer’s name and full address ( including ZIP code )

W-2

Record 1

Box 12a Amount

Box 15 State

Box 16 State wages, tips, etc. ( for NYS )

Code

Box b Employer identification number ( EIN )

Box 12b Amount

Code

Box 17 New York State income tax withheld

This W-2 record is for

( mark an X in one box ):

Box 12c Amount

Code

Box 18 Local wages, tips, etc.

( see instr. )

Taxpayer

Spouse

Locality a

Box 1 Wages, tips, other compensation

Box 12d Amount

Code

Locality b

Box 19 Local income tax withheld

Box 8 Allocated tips

Locality a

Box 13 Statutory employee

Locality b

Box 9 Advance EIC payment

Box 14 a Amount

Box 20 Locality name

Description

Locality a

Box 10 Dependent care benefits

Box 14 b Amount

Description

Locality b

Box 11 Nonqualified plans

Box 14 c Amount

Description

Corrected ( W-2c)

Do not detach.

Box c Employer’s name and full address ( including ZIP code )

W-2

Record 2

Box 12a Amount

Code

Box 15 State

Box 16 State wages, tips, etc. ( for NYS )

Box b Employer identification number ( EIN )

Box 12b Amount

Code

Box 17 New York State income tax withheld

This W-2 record is for

( mark an X in one box ):

Box 12c Amount

Code

Box 18 Local wages, tips, etc.

( see instr. )

Taxpayer

Spouse

Locality a

Box 1 Wages, tips, other compensation

Box 12d Amount

Code

Locality b

Box 19 Local income tax withheld

Box 8 Allocated tips

Locality a

Box 13 Statutory employee

Locality b

Box 9 Advance EIC payment

Box 14 a Amount

Description

Box 20 Locality name

Locality a

Box 10 Dependent care benefits

Box 14 b Amount

Description

Locality b

Box 11 Nonqualified plans

Box 14 c Amount

Description

Corrected ( W-2c)

Please file this original scannable form with the Tax Department.

If you or your paid preparer use software to produce this form,

it might have a two-dimensional (2-D) barcode on the bottom of

this page. It will appear as a rectangular-shaped object with very

small black boxes and white spaces. This barcode will be used to

efficiently process your entries on this form.

1021090094

1

1 2

2