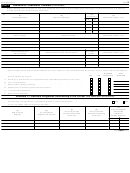

2

Form 3520 (2017)

Page

Part I

Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year (see instructions)

5a

b Address

Name of trust creator

c Identification number (if any)

6a

Country code of country where trust was created

b Country code of country whose law governs the trust

c Date trust was created

Will any person (other than the U.S. transferor or the foreign trust) be treated as the owner of the transferred assets after

7 a

the transfer?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

(i)

(v)

b

(ii)

(iii)

(iv)

Name of other foreign

Relevant Code

Address

Country of residence

Identification number, if any

trust owners, if any

section

8

Was the transfer a completed gift or bequest? If “Yes,” see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

9a

Yes

No

Now or at any time in the future, can any part of the income or corpus of the trust benefit any U.S. beneficiary? .

.

.

b

If “No,” could the trust be revised or amended to benefit a U.S. beneficiary?.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

10

Will you continue to be treated as the owner of the transferred asset(s) after the transfer? .

.

.

.

.

.

.

.

.

.

Yes

No

Schedule A—Obligations of a Related Trust (see instructions)

11 a

During the current tax year, did you transfer property (including cash) to a related foreign trust in exchange for an

obligation of the trust or an obligation of a person related to the trust (see instructions)? .

.

.

.

.

.

.

.

.

.

Yes

No

If “Yes,” complete the rest of Schedule A, as applicable. If “No,” go to Schedule B.

b

Yes

No

Were any of the obligations you received (with respect to a transfer described in line 11a above) qualified obligations? .

If “Yes,” complete the rest of Schedule A with respect to each qualified obligation.

If “No,” go to Schedule B and, when completing columns (a) through (i) of line 13 with respect to each nonqualified

obligation, enter “-0-” in column (h).

(i)

(ii)

(iii)

(iv)

Date of transfer giving rise to obligation

Maximum term

Yield to maturity

FMV of obligation

12

With respect to each qualified obligation you reported on line 11b: Do you agree to extend the period of assessment of

any income or transfer tax attributable to the transfer, and any consequential income tax changes for each year that the

obligation is outstanding, to a date 3 years after the maturity date of the obligation?

.

.

.

.

.

.

.

.

.

.

.

Yes

No

Note: You have the right to refuse to extend the period of limitations or limit this extension to a mutually agreed-upon

issue(s) or mutually agreed-upon period of time. Generally, if you refuse to extend the period of limitations with respect

to each qualified obligation you reported on line 11b, then such obligation is not a qualified obligation and you cannot

check “Yes” to the question on line 11b.

Schedule B—Gratuitous Transfers (see instructions)

13

During the current tax year, did you make any transfers (directly or indirectly) to the trust and receive less than FMV,

or no consideration at all, for the property transferred? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If “Yes,” complete columns (a) through (i) below and the rest of Schedule B, as applicable.

If “No,” go to Schedule C.

(f)

(d)

(e)

(g)

(b)

Excess, if any,

(i)

(a)

(c)

U.S. adjusted

Gain recognized

Description

(h)

Description

of column (c)

Excess of

Date of

FMV of property

basis of

at time of

of property

FMV of property

of property

over the sum of

column (c) over

transfer

transferred

property

transfer,

received,

received

transferred

columns

column (h)

transferred

if any

if any

(d) and (e)

Totals

$

$

▶

14

You are required to attach a copy of each sale or loan document entered into in connection with a transfer reported on line 13. If these

documents have been attached to a Form 3520 filed within the previous 3 years, attach only relevant updates.

Attached

Year

Yes

No

Previously

Attached

Are you attaching a copy of:

a

Sale document?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b

Loan document? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c

Subsequent variances to original sale or loan documents? .

.

.

.

.

.

.

.

.

.

3520

Form

(2017)

1

1 2

2 3

3 4

4 5

5 6

6