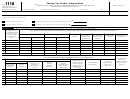

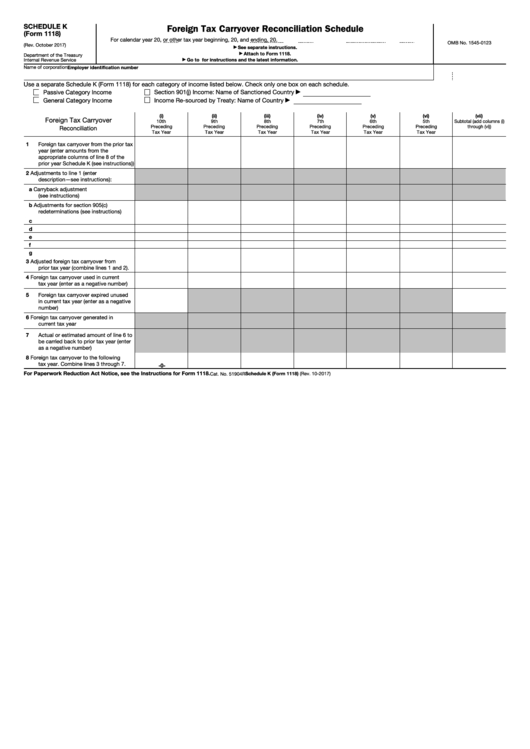

SCHEDULE K

Foreign Tax Carryover Reconciliation Schedule

(Form 1118)

For calendar year 20

, or other tax year beginning

, 20

, and ending

, 20

.

OMB No. 1545-0123

(Rev. October 2017)

See separate instructions.

▶

Attach to Form 1118.

▶

Department of the Treasury

Internal Revenue Service

Go to for instructions and the latest information.

▶

Name of corporation

Employer identification number

Use a separate Schedule K (Form 1118) for each category of income listed below. Check only one box on each schedule.

Passive Category Income

Section 901(j) Income: Name of Sanctioned Country

▶

General Category Income

Income Re-sourced by Treaty: Name of Country

▶

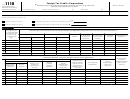

(i)

(ii)

(iii)

(iv)

(v)

(vi)

(vii)

Foreign Tax Carryover

10th

9th

8th

7th

6th

5th

Subtotal (add columns (i)

Preceding

Preceding

Preceding

Preceding

Preceding

Preceding

through (vi))

Reconciliation

Tax Year

Tax Year

Tax Year

Tax Year

Tax Year

Tax Year

1

Foreign tax carryover from the prior tax

year (enter amounts from the

appropriate columns of line 8 of the

prior year Schedule K (see instructions))

2

Adjustments to line 1 (enter

description—see instructions):

a

Carryback adjustment

(see instructions)

b

Adjustments for section 905(c)

redeterminations (see instructions)

c

d

e

f

g

3

Adjusted foreign tax carryover from

prior tax year (combine lines 1 and 2).

4

Foreign tax carryover used in current

tax year (enter as a negative number)

5

Foreign tax carryover expired unused

in current tax year (enter as a negative

number)

6

Foreign tax carryover generated in

current tax year

7

Actual or estimated amount of line 6 to

be carried back to prior tax year (enter

as a negative number)

8

Foreign tax carryover to the following

tax year. Combine lines 3 through 7.

-0-

For Paperwork Reduction Act Notice, see the Instructions for Form 1118.

Schedule K (Form 1118) (Rev. 10-2017)

Cat. No. 51904R

1

1 2

2