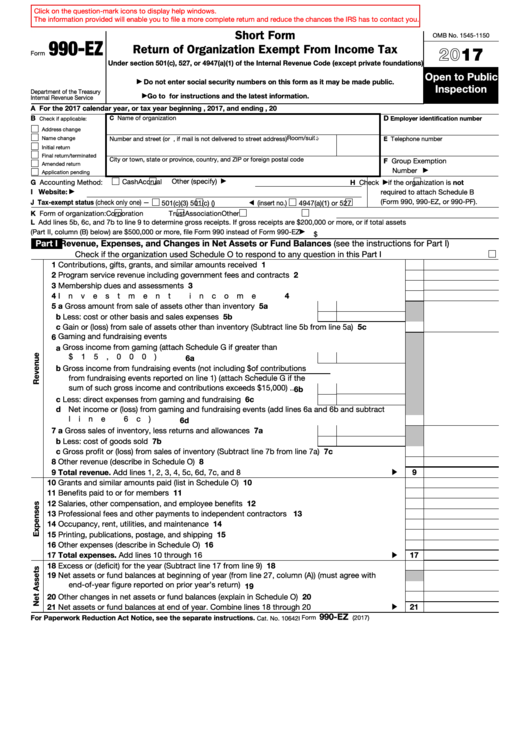

Click on the question-mark icons to display help windows.

The information provided will enable you to file a more complete return and reduce the chances the IRS has to contact you.

Short Form

OMB No. 1545-1150

990-EZ

Return of Organization Exempt From Income Tax

2017

Form

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

Open to Public

Do not enter social security numbers on this form as it may be made public.

▶

Inspection

Department of the Treasury

Go to for instructions and the latest information.

▶

Internal Revenue Service

A For the 2017 calendar year, or tax year beginning

, 2017, and ending

, 20

B

D

C Name of organization

?? help

?? help

Employer identification number

Check if applicable:

Address change

Room/suite

Name change

Number and street (or P.O. box, if mail is not delivered to street address)

?? help

E Telephone number

Initial return

Final return/terminated

City or town, state or province, country, and ZIP or foreign postal code

F Group Exemption

Amended return

Number

▶

?? help

Application pending

Other (specify)

Cash

Accrual

G Accounting Method:

H Check

if the organization is not

▶

▶

I Website:

required to attach Schedule B

▶

?? help

(Form 990, 990-EZ, or 990-PF).

J Tax-exempt status (check only one) —

501(c)(3)

501(c) (

)

(insert no.)

4947(a)(1) or

527

◀

K Form of organization:

Corporation

Trust

Association

Other

L Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total assets

(Part II, column (B) below) are $500,000 or more, file Form 990 instead of Form 990-EZ

.

.

.

.

.

.

.

.

.

.

▶

$

Part I

Revenue, Expenses, and Changes in Net Assets or Fund Balances (see the instructions for Part I)

?? help

Check if the organization used Schedule O to respond to any question in this Part I . . . . . . . . . .

1

Contributions, gifts, grants, and similar amounts received .

.

.

.

.

.

.

.

.

.

.

.

.

1

?? help

2

Program service revenue including government fees and contracts

.

.

.

.

.

.

.

.

.

2

?? help

3

Membership dues and assessments .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

?? help

4

Investment income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

?? help

5 a Gross amount from sale of assets other than inventory

.

.

.

.

5a

b Less: cost or other basis and sales expenses .

.

.

.

.

.

.

.

5b

c Gain or (loss) from sale of assets other than inventory (Subtract line 5b from line 5a) .

.

.

.

5c

Gaming and fundraising events

6

a Gross income from gaming (attach Schedule G if greater than

$15,000) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6a

b Gross income from fundraising events (not including $

of contributions

from fundraising events reported on line 1) (attach Schedule G if the

sum of such gross income and contributions exceeds $15,000) .

.

6b

c Less: direct expenses from gaming and fundraising events

.

.

.

6c

d Net income or (loss) from gaming and fundraising events (add lines 6a and 6b and subtract

line 6c)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6d

7 a Gross sales of inventory, less returns and allowances .

.

.

.

.

7a

b Less: cost of goods sold

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7b

c Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a) .

.

.

.

.

.

.

7c

8

Other revenue (describe in Schedule O) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Total revenue. Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8

.

.

.

.

.

.

.

.

.

.

.

.

.

9

▶

10

Grants and similar amounts paid (list in Schedule O)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Benefits paid to or for members .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

Salaries, other compensation, and employee benefits .

.

.

.

.

.

.

.

.

.

.

.

.

.

12

?? help

13

Professional fees and other payments to independent contractors .

.

.

.

.

.

.

.

.

.

13

?? help

14

Occupancy, rent, utilities, and maintenance

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

15

Printing, publications, postage, and shipping .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

16

Other expenses (describe in Schedule O) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

?? help

17

Total expenses. Add lines 10 through 16 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

▶

18

Excess or (deficit) for the year (Subtract line 17 from line 9)

.

.

.

.

.

.

.

.

.

.

.

.

18

19

Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with

end-of-year figure reported on prior year’s return)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

20

Other changes in net assets or fund balances (explain in Schedule O) .

.

.

.

.

.

.

.

.

20

21

Net assets or fund balances at end of year. Combine lines 18 through 20

.

.

.

.

.

.

21

▶

990-EZ

For Paperwork Reduction Act Notice, see the separate instructions.

Form

(2017)

Cat. No. 10642I

1

1 2

2 3

3 4

4