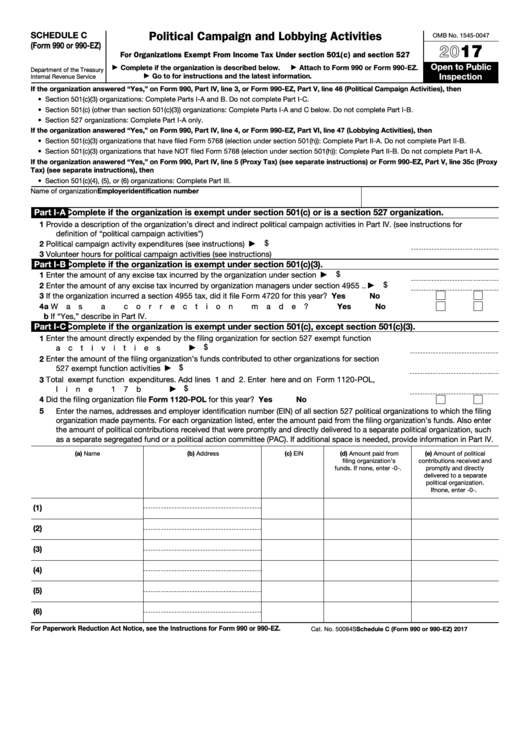

Political Campaign and Lobbying Activities

SCHEDULE C

OMB No. 1545-0047

(Form 990 or 990-EZ)

20

17

For Organizations Exempt From Income Tax Under section 501(c) and section 527

Open to Public

Complete if the organization is described below.

Attach to Form 990 or Form 990-EZ.

▶

▶

Department of the Treasury

Inspection

Go to for instructions and the latest information.

Internal Revenue Service

▶

If the organization answered “Yes,” on Form 990, Part IV, line 3, or Form 990-EZ, Part V, line 46 (Political Campaign Activities), then

• Section 501(c)(3) organizations: Complete Parts I-A and B. Do not complete Part I-C.

• Section 501(c) (other than section 501(c)(3)) organizations: Complete Parts I-A and C below. Do not complete Part I-B.

• Section 527 organizations: Complete Part I-A only.

If the organization answered “Yes,” on Form 990, Part IV, line 4, or Form 990-EZ, Part VI, line 47 (Lobbying Activities), then

• Section 501(c)(3) organizations that have filed Form 5768 (election under section 501(h)): Complete Part II-A. Do not complete Part II-B.

• Section 501(c)(3) organizations that have NOT filed Form 5768 (election under section 501(h)): Complete Part II-B. Do not complete Part II-A.

If the organization answered “Yes,” on Form 990, Part IV, line 5 (Proxy Tax) (see separate instructions) or Form 990-EZ, Part V, line 35c (Proxy

Tax) (see separate instructions), then

• Section 501(c)(4), (5), or (6) organizations: Complete Part III.

Name of organization

Employer identification number

Part I-A

Complete if the organization is exempt under section 501(c) or is a section 527 organization.

1

Provide a description of the organization’s direct and indirect political campaign activities in Part IV. (see instructions for

definition of “political campaign activities”)

$

2

Political campaign activity expenditures (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

▶

3

Volunteer hours for political campaign activities (see instructions)

.

.

.

.

.

.

.

.

.

.

.

Part I-B

Complete if the organization is exempt under section 501(c)(3).

$

1

Enter the amount of any excise tax incurred by the organization under section 4955 .

.

.

.

▶

$

2

Enter the amount of any excise tax incurred by organization managers under section 4955 .

.

▶

3

Yes

No

If the organization incurred a section 4955 tax, did it file Form 4720 for this year? .

.

.

.

.

.

.

.

.

4a Was a correction made? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

b If “Yes,” describe in Part IV.

Part I-C

Complete if the organization is exempt under section 501(c), except section 501(c)(3).

1

Enter the amount directly expended by the filing organization for section 527 exempt function

$

activities .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

2

Enter the amount of the filing organization’s funds contributed to other organizations for section

$

527 exempt function activities .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

3

Total exempt function expenditures. Add lines 1 and 2. Enter here and on Form 1120-POL,

$

line 17b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

4

Did the filing organization file Form 1120-POL for this year? .

Yes

No

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Enter the names, addresses and employer identification number (EIN) of all section 527 political organizations to which the filing

organization made payments. For each organization listed, enter the amount paid from the filing organization’s funds. Also enter

the amount of political contributions received that were promptly and directly delivered to a separate political organization, such

as a separate segregated fund or a political action committee (PAC). If additional space is needed, provide information in Part IV.

(a) Name

(b) Address

(c) EIN

(d) Amount paid from

(e) Amount of political

filing organization’s

contributions received and

funds. If none, enter -0-.

promptly and directly

delivered to a separate

political organization.

If none, enter -0-.

(1)

(2)

(3)

(4)

(5)

(6)

For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ.

Cat. No. 50084S

Schedule C (Form 990 or 990-EZ) 2017

1

1 2

2 3

3 4

4