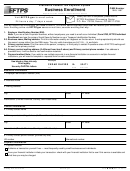

Electronic Federal Tax Payment System - Business Enrollment

(Questions 9 through 13 must be completed if scheduling payments yourself and not through your financial institution.)

9. Routing Transit Number (RTN). This is the nine-digit number associated with your financial institution. You may contact your

financial institution to verify this number.

10. Account number. Enter the number of the account you will use to pay your taxes.

12. Authorization. This section authorizes a Financial Agent of the U.S. Department of the Treasury to initiate the payments you

authorize.

13. Authorized signature. The authorized individual must sign this section to authorize participation in EFTPS. If there is no signature,

a form will be returned. This section also provides authorization to share the information provided with your financial institution(s)

required for EFTPS. If signed on behalf of the taxpayer, the signer certifies authority to execute this authorization.

Remember to sign and mail your enrollment form to the address on reverse side.

Employer Identification Number

Employer Identification Number (EIN) (Reenter - should match EIN on first page)

Financial Institution Information

9. Routing Transit Number (RTN)

10. Account number

11. Type of account

Checking

Savings

Authorization

12. Read the following Authorization Agreements

Disclosure Authorization Agreement

I hereby authorize the contact person listed in item 4 on this form and financial institutions involved in the processing of my Electronic Federal Tax Payment System

(EFTPS) payments to receive confidential information necessary to effect enrollment in EFTPS, electronic payment of taxes, answer inquiries and resolve issues related

to enrollment and payments. This information includes, but is not limited to, passwords, payment instructions, taxpayer name and identifying number, and payment

transaction details. This authorization is to remain in full force and effect until the designated Financial Agents of the U.S. Treasury have received written notification from

me of termination in such time and in such manner to afford a reasonable opportunity to act on it.

Debit Authorization Agreement

By completing the financial institution information in items 9-11 on this form, I authorize designated Financial Agents of the U.S. Treasury to initiate EFTPS debit entries

to the financial institution account indicated above, for payment of federal taxes owed to the IRS upon request by Taxpayer or his/her representative, using the Electronic

Federal Tax Payment System (EFTPS). I further authorize the financial institution named above to debit such entries to the financial institution account indicated above.

All debits initiated by the U.S. Treasury designated Financial Agents pursuant to this authorization shall be made under U.S. Treasury regulations. This authorization is to

remain in full force and effect until the designated Financial Agents of the U.S. Treasury have received written notification of termination in such time and in such manner

as to afford a reasonable opportunity to act on it.

Authority to Execute an Authorization

If signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have the authority to have payments made from the taxpayer’s account. If

signed by a representative of the taxpayer, I certify that I have the authority to execute this authorization on behalf of the taxpayer (i.e., authority provided by Form 2848,

Power of Attorney and Declaration of Representative, or Form 8655, Reporting Agent Authorization for Magnetic Tape/Electronic Filers).

13. Authorized signature

Name of authorized signature (print)

Authorized signature

Date signed

Remember to sign and mail your business enrollment form to the address on reverse side

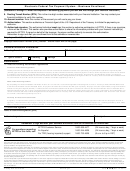

EFTPS Customer Service

1-800-555-4477

(24 hours a day, 7 days a week)

For questions regarding

En Español

1-800-244-4829

(24 hours a day, 7 days a week)

EFTPS or this form, call:

For TDD (hearing impaired) support

1-800-733-4829

(8 a.m. to 8 p.m. EST)

Privacy Act and Paperwork Reduction Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need this information to ensure that you are complying with the revenue laws and to allow us to

figure and collect the right amount of tax. Our authority to ask for this information is 5 U.S.C. 301 and Internal Revenue Code sections 6001, 6011, 6012, and their applicable regulations. Section 6109

requires filers to provide their SSN or other identifying numbers. The information will be used to enroll you in the Electronic Federal Tax Payment System (EFTPS) and to ensure that payment(s) are

properly credited to the appropriate account(s).

Generally, tax returns and return information are confidential, as stated in section 6103 of the Internal Revenue Code. However, section 6103 allows or requires the Internal Revenue Service to disclose

such information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws.

We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to

combat terrorism. If you are required by regulation to use electronic funds transfer to make your deposits, your response is mandatory; failure to provide all of the requested information or providing false

or fraudulent information may subject you to penalties. If you are not required by regulation to use electronic funds transfer, your response is voluntary; failure to provide all of the requested information

may prevent processing of this form, and providing false or fraudulent information may subject you to penalties. If you are not required to use electronic funds transfer to pay taxes owed, you need to pay

the taxes due by another method.

You are not required to provide information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or

its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. The time needed to provide this information will vary depending on

individual circumstances. The estimated average time is ten minutes. If you have comments concerning the accuracy of this time estimate or suggestions for reducing this burden, we would be happy to

hear from you. You can write to the IRS Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR 6526, Washington, DC 20224. Please do not send the enrollment

form to this address.

9779

Catalog Number 21816U

Form

(Rev. 12-2011)

1

1 2

2