Form 706 (Rev. 8-2017)

Decedent’s social security number

Estate of:

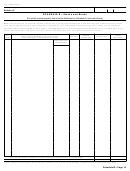

Part 6—Portability of Deceased Spousal Unused Exclusion (DSUE)

Portability Election

A decedent with a surviving spouse elects portability of the deceased spousal unused exclusion (DSUE) amount, if any, by completing and timely-filing

this return. No further action is required to elect portability of the DSUE amount to allow the surviving spouse to use the decedent's DSUE amount.

Section A. Opting Out of Portability

The estate of a decedent with a surviving spouse may opt out of electing portability of the DSUE amount. Check here and do not complete Sections B

and C of Part 6 only if the estate opts NOT to elect portability of the DSUE amount.

Section B. QDOT

Yes No

Are any assets of the estate being transferred to a qualified domestic trust (QDOT)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If “Yes,” the DSUE amount portable to a surviving spouse (calculated in Section C, below) is preliminary and shall be redetermined at the time of the

final distribution or other taxable event imposing estate tax under section 2056A. See instructions for more details.

Section C. DSUE Amount Portable to the Surviving Spouse

(To be completed by the estate of a decedent making a portability

election.)

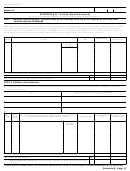

Complete the following calculation to determine the DSUE amount that can be transferred to the surviving spouse.

1

1

Enter the amount from line 9d, Part 2—Tax Computation

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Reserved

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Enter the value of the cumulative lifetime gifts on which tax was paid or payable (see instructions) .

.

.

3

4

Add lines 1 and 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

5

Enter amount from line 10, Part 2—Tax Computation

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Divide amount on line 5 by 40% (0.40) (do not enter less than zero)

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Subtract line 6 from line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

8

Enter the amount from line 5, Part 2—Tax Computation .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Subtract line 8 from line 7 (do not enter less than zero) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

DSUE amount portable to surviving spouse (Enter lesser of line 9 or line 9a, Part 2—Tax Computation) .

.

10

Section D. DSUE Amount Received from Predeceased Spouse(s)

(To be completed by the estate of a deceased surviving

spouse with DSUE amount from predeceased spouse(s))

Provide the following information to determine the DSUE amount received from deceased spouses.

E

G

A

C

D

F

DSUE Amount

Remaining DSUE

B

Name of Deceased Spouse

Portability

If “Yes,” DSUE

Year of Form 709

Applied by

Amount, if any

Date of Death

(dates of death after

Election

Amount Received

Reporting Use of DSUE

(enter as mm/dd/yy)

Decedent to

(subtract col. E

December 31, 2010, only)

Made?

from Spouse

Amount Listed in col E

Lifetime Gifts

from col. D)

Yes

No

Part 1 — DSUE RECEIVED FROM LAST DECEASED SPOUSE

Part 2 — DSUE RECEIVED FROM OTHER PREDECEASED SPOUSE(S) AND USED BY DECEDENT

Total (for all DSUE amounts from predeceased spouse(s) applied) .

.

.

Add the amount from Part 1, column D and the total from Part 2, column E. Enter the result on line 9b, Part 2—Tax

Computation

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Page 4

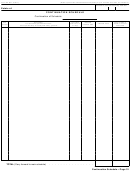

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31