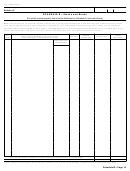

SCHEDULE R-1

Generation-Skipping Transfer Tax

(Form 706)

OMB No. 1545-0015

(Rev. August 2017)

Direct Skips From a Trust

Department of the Treasury

Payment Voucher

Internal Revenue Service

Executor: File one copy with Form 706 and send two copies to the fiduciary. Do not pay the tax shown. See instructions for details.

Fiduciary: See instructions for details. Pay the tax shown on line 6.

Name of trust

Trust’s EIN

Name and title of fiduciary

Name of decedent

Address of fiduciary (number and street)

Decedent’s SSN

Service Center where Form 706 was filed

City, state, and ZIP or postal code

Name of executor

Address of executor (number and street)

City, state, and ZIP or postal code

Date of decedent’s death

Filing due date of Schedule R, Form 706 (with extensions)

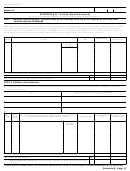

Part 1. Computation of the GST Tax on the Direct Skip

Description of property interests subject to the direct skip

Estate tax value

1 Total estate tax value of all property interests listed above

1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2 Estate taxes, state death taxes, and other charges borne by the property interests listed above .

.

2

3 Tentative maximum direct skip from trust (subtract line 2 from line 1) .

.

.

.

.

.

.

.

.

.

.

3

4 GST exemption allocated .

4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5 Subtract line 4 from line 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 GST tax due from fiduciary (divide line 5 by 3.5). (See instructions if property will not bear the

GST tax.)

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Under penalties of perjury, I declare that I have examined this document, including accompanying schedules and statements, and to the best of my knowledge and belief, it

is true, correct, and complete.

Signature(s) of executor(s)

Date

Date

Date

Signature of fiduciary or officer representing fiduciary

Schedule R-1—Page 26

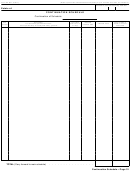

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31