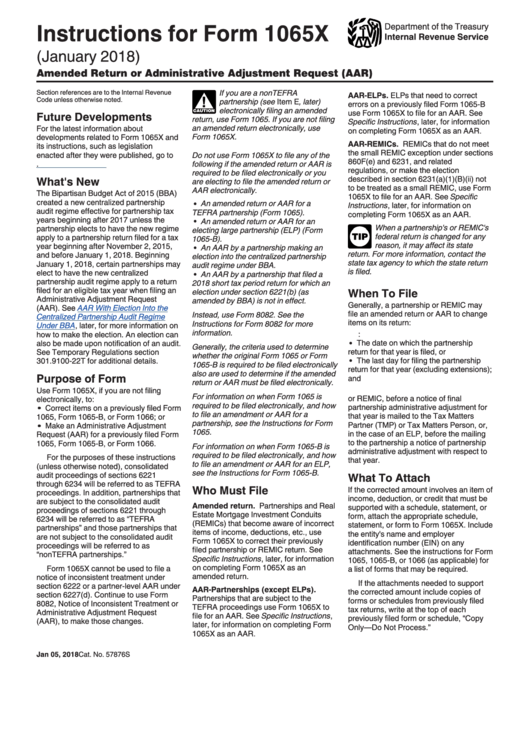

Instructions For Form 1065x - Amended Return Or Administrative Adjustment Request (Aar) - 2012

ADVERTISEMENT

Instructions for Form 1065X

Department of the Treasury

Internal Revenue Service

(January 2018)

Amended Return or Administrative Adjustment Request (AAR)

If you are a nonTEFRA

Section references are to the Internal Revenue

AAR-ELPs. ELPs that need to correct

Code unless otherwise noted.

partnership (see Item E, later)

!

errors on a previously filed Form 1065-B

electronically filing an amended

use Form 1065X to file for an AAR. See

Future Developments

CAUTION

return, use Form 1065. If you are not filing

Specific Instructions, later, for information

an amended return electronically, use

For the latest information about

on completing Form 1065X as an AAR.

Form 1065X.

developments related to Form 1065X and

AAR-REMICs. REMICs that do not meet

its instructions, such as legislation

the small REMIC exception under sections

enacted after they were published, go to

Do not use Form 1065X to file any of the

860F(e) and 6231, and related

IRS.gov/Form1065X.

following if the amended return or AAR is

regulations, or make the election

required to be filed electronically or you

What's New

described in section 6231(a)(1)(B)(ii) not

are electing to file the amended return or

to be treated as a small REMIC, use Form

AAR electronically.

The Bipartisan Budget Act of 2015 (BBA)

1065X to file for an AAR. See Specific

created a new centralized partnership

An amended return or AAR for a

Instructions, later, for information on

audit regime effective for partnership tax

TEFRA partnership (Form 1065).

completing Form 1065X as an AAR.

years beginning after 2017 unless the

An amended return or AAR for an

When a partnership's or REMIC's

partnership elects to have the new regime

electing large partnership (ELP) (Form

federal return is changed for any

apply to a partnership return filed for a tax

1065-B).

TIP

reason, it may affect its state

year beginning after November 2, 2015,

An AAR by a partnership making an

return. For more information, contact the

and before January 1, 2018. Beginning

election into the centralized partnership

state tax agency to which the state return

January 1, 2018, certain partnerships may

audit regime under BBA.

is filed.

elect to have the new centralized

An AAR by a partnership that filed a

partnership audit regime apply to a return

2018 short tax period return for which an

filed for an eligible tax year when filing an

When To File

election under section 6221(b) (as

Administrative Adjustment Request

amended by BBA) is not in effect.

Generally, a partnership or REMIC may

(AAR). See

AAR With Election Into the

file an amended return or AAR to change

Instead, use Form 8082. See the

Centralized Partnership Audit Regime

items on its return:

Instructions for Form 8082 for more

Under

BBA, later, for more information on

information.

how to make the election. An election can

1. Within 3 years after the later of:

also be made upon notification of an audit.

The date on which the partnership

Generally, the criteria used to determine

return for that year is filed, or

See Temporary Regulations section

whether the original Form 1065 or Form

The last day for filing the partnership

301.9100-22T for additional details.

1065-B is required to be filed electronically

return for that year (excluding extensions);

also are used to determine if the amended

Purpose of Form

and

return or AAR must be filed electronically.

2. In the case of a TEFRA partnership

Use Form 1065X, if you are not filing

For information on when Form 1065 is

or REMIC, before a notice of final

electronically, to:

required to be filed electronically, and how

partnership administrative adjustment for

Correct items on a previously filed Form

to file an amendment or AAR for a

that year is mailed to the Tax Matters

1065, Form 1065-B, or Form 1066; or

partnership, see the Instructions for Form

Partner (TMP) or Tax Matters Person, or,

Make an Administrative Adjustment

1065.

in the case of an ELP, before the mailing

Request (AAR) for a previously filed Form

to the partnership a notice of partnership

1065, Form 1065-B, or Form 1066.

For information on when Form 1065-B is

administrative adjustment with respect to

required to be filed electronically, and how

For the purposes of these instructions

that year.

to file an amendment or AAR for an ELP,

(unless otherwise noted), consolidated

see the Instructions for Form 1065-B.

audit proceedings of sections 6221

What To Attach

through 6234 will be referred to as TEFRA

Who Must File

If the corrected amount involves an item of

proceedings. In addition, partnerships that

income, deduction, or credit that must be

are subject to the consolidated audit

Amended return. Partnerships and Real

supported with a schedule, statement, or

proceedings of sections 6221 through

Estate Mortgage Investment Conduits

form, attach the appropriate schedule,

6234 will be referred to as “TEFRA

(REMICs) that become aware of incorrect

statement, or form to Form 1065X. Include

partnerships” and those partnerships that

items of income, deductions, etc., use

the entity's name and employer

are not subject to the consolidated audit

Form 1065X to correct their previously

identification number (EIN) on any

proceedings will be referred to as

filed partnership or REMIC return. See

attachments. See the instructions for Form

“nonTEFRA partnerships.”

Specific Instructions, later, for information

1065, 1065-B, or 1066 (as applicable) for

on completing Form 1065X as an

Form 1065X cannot be used to file a

a list of forms that may be required.

amended return.

notice of inconsistent treatment under

If the attachments needed to support

section 6222 or a partner-level AAR under

AAR-Partnerships (except ELPs).

the corrected amount include copies of

section 6227(d). Continue to use Form

Partnerships that are subject to the

forms or schedules from previously filed

8082, Notice of Inconsistent Treatment or

TEFRA proceedings use Form 1065X to

tax returns, write at the top of each

Administrative Adjustment Request

file for an AAR. See Specific Instructions,

previously filed form or schedule, “Copy

(AAR), to make those changes.

later, for information on completing Form

Only—Do Not Process.”

1065X as an AAR.

Jan 05, 2018

Cat. No. 57876S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6