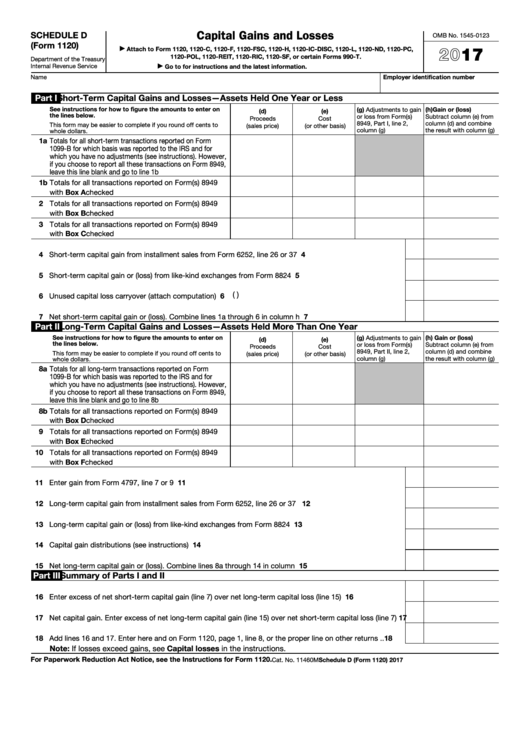

Capital Gains and Losses

SCHEDULE D

OMB No. 1545-0123

(Form 1120)

2017

Attach to Form 1120, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND, 1120-PC,

▶

1120-POL, 1120-REIT, 1120-RIC, 1120-SF, or certain Forms 990-T.

Department of the Treasury

Internal Revenue Service

Go to for instructions and the latest information.

▶

Name

Employer identification number

Part I

Short-Term Capital Gains and Losses—Assets Held One Year or Less

See instructions for how to figure the amounts to enter on

(g) Adjustments to gain

(h) Gain or (loss)

(d)

(e)

the lines below.

or loss from Form(s)

Subtract column (e) from

Proceeds

Cost

8949, Part I, line 2,

column (d) and combine

This form may be easier to complete if you round off cents to

(sales price)

(or other basis)

column (g)

the result with column (g)

whole dollars.

1a Totals for all short-term transactions reported on Form

1099-B for which basis was reported to the IRS and for

which you have no adjustments (see instructions). However,

if you choose to report all these transactions on Form 8949,

leave this line blank and go to line 1b .

.

.

.

.

.

1b Totals for all transactions reported on Form(s) 8949

with Box A checked

.

.

.

.

.

.

.

.

.

.

2 Totals for all transactions reported on Form(s) 8949

with Box B checked

.

.

.

.

.

.

.

.

.

.

3 Totals for all transactions reported on Form(s) 8949

with Box C checked

.

.

.

.

.

.

.

.

.

.

4 Short-term capital gain from installment sales from Form 6252, line 26 or 37 .

4

.

.

.

.

.

.

.

.

.

5 Short-term capital gain or (loss) from like-kind exchanges from Form 8824

.

.

.

.

.

.

.

.

.

.

5

(

)

6 Unused capital loss carryover (attach computation)

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column h

.

.

.

.

.

.

.

.

.

7

Part II

Long-Term Capital Gains and Losses—Assets Held More Than One Year

See instructions for how to figure the amounts to enter on

(g) Adjustments to gain

(h) Gain or (loss)

(d)

(e)

the lines below.

or loss from Form(s)

Subtract column (e) from

Proceeds

Cost

8949, Part II, line 2,

column (d) and combine

This form may be easier to complete if you round off cents to

(sales price)

(or other basis)

column (g)

the result with column (g)

whole dollars.

8a Totals for all long-term transactions reported on Form

1099-B for which basis was reported to the IRS and for

which you have no adjustments (see instructions). However,

if you choose to report all these transactions on Form 8949,

leave this line blank and go to line 8b .

.

.

.

.

.

8b Totals for all transactions reported on Form(s) 8949

with Box D checked

.

.

.

.

.

.

.

.

.

.

9 Totals for all transactions reported on Form(s) 8949

with Box E checked

.

.

.

.

.

.

.

.

.

.

10 Totals for all transactions reported on Form(s) 8949

with Box F checked

.

.

.

.

.

.

.

.

.

.

11 Enter gain from Form 4797, line 7 or 9 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12 Long-term capital gain from installment sales from Form 6252, line 26 or 37 .

.

.

.

.

.

.

.

.

.

12

13 Long-term capital gain or (loss) from like-kind exchanges from Form 8824

13

.

.

.

.

.

.

.

.

.

.

14 Capital gain distributions (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column h

.

.

.

.

.

.

.

.

.

15

Part III

Summary of Parts I and II

16 Enter excess of net short-term capital gain (line 7) over net long-term capital loss (line 15)

.

.

.

.

.

16

17 Net capital gain. Enter excess of net long-term capital gain (line 15) over net short-term capital loss (line 7)

17

18 Add lines 16 and 17. Enter here and on Form 1120, page 1, line 8, or the proper line on other returns .

18

.

Note: If losses exceed gains, see Capital losses in the instructions.

For Paperwork Reduction Act Notice, see the Instructions for Form 1120.

Cat. No. 11460M

Schedule D (Form 1120) 2017

1

1