OMB No. 1545-1316

Filing Assistance Program

9452

Form

2016

(Do you have to file a Federal Income Tax Return?)

Department of the Treasury

►

See instructions on back.

Internal Revenue Service

Do not send to IRS.

Keep for your records.

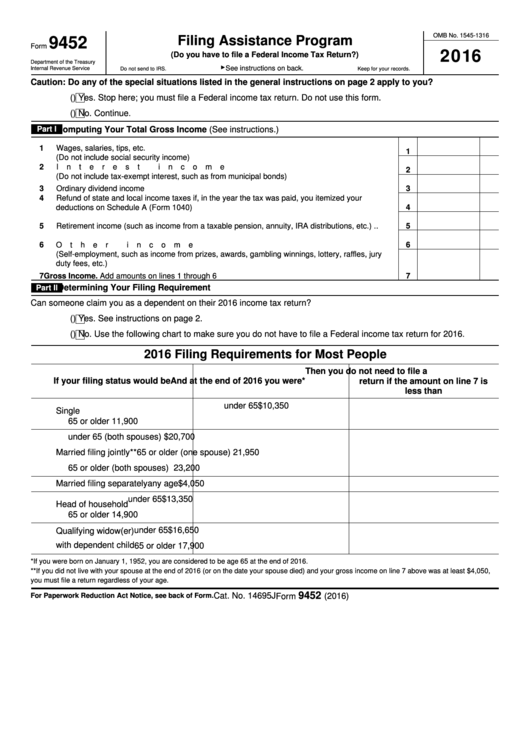

Caution: Do any of the special situations listed in the general instructions on page 2 apply to you?

(

) Yes. Stop here; you must file a Federal income tax return. Do not use this form.

(

) No. Continue.

Part I

Computing Your Total Gross Income (See instructions.)

1

Wages, salaries, tips, etc.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

(Do not include social security income)

2

Interest income .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

(Do not include tax-exempt interest, such as from municipal bonds)

3

Ordinary dividend income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Refund of state and local income taxes if, in the year the tax was paid, you itemized your

deductions on Schedule A (Form 1040) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Retirement income (such as income from a taxable pension, annuity, IRA distributions, etc.) .

.

5

6

Other income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

(Self-employment, such as income from prizes, awards, gambling winnings, lottery, raffles, jury

duty fees, etc.)

7

Gross Income. Add amounts on lines 1 through 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Determining Your Filing Requirement

Part II

Can someone claim you as a dependent on their 2016 income tax return?

(

) Yes. See instructions on page 2.

(

) No. Use the following chart to make sure you do not have to file a Federal income tax return for 2016.

2016 Filing Requirements for Most People

Then you do not need to file a

If your filing status would be

And at the end of 2016 you were*

return if the amount on line 7 is

less than

under 65

$10,350

Single

65 or older

11,900

under 65 (both spouses)

$20,700

Married filing jointly**

65 or older (one spouse)

21,950

65 or older (both spouses)

23,200

Married filing separately

any age

$4,050

under 65

$13,350

Head of household

65 or older

14,900

under 65

$16,650

Qualifying widow(er)

with dependent child

65 or older

17,900

*If you were born on January 1, 1952, you are considered to be age 65 at the end of 2016.

**If you did not live with your spouse at the end of 2016 (or on the date your spouse died) and your gross income on line 7 above was at least $4,050,

you must file a return regardless of your age.

9452

Cat. No. 14695J

Form

(2016)

For Paperwork Reduction Act Notice, see back of Form.

1

1 2

2