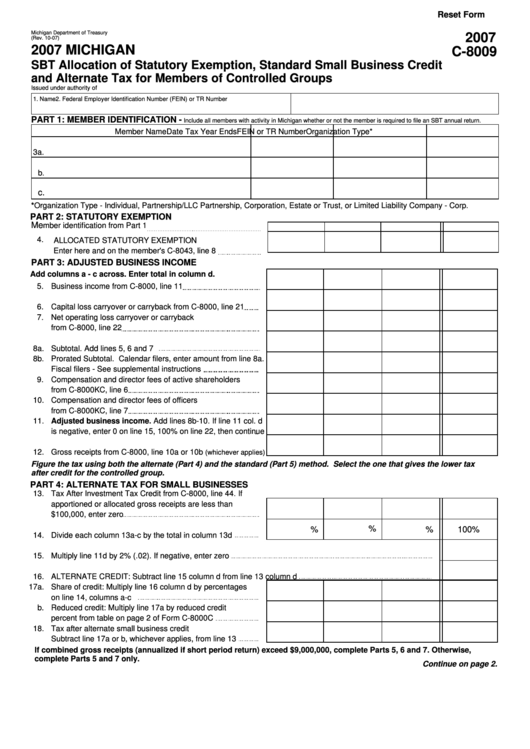

Reset Form

Michigan Department of Treasury

2007

(Rev. 10-07)

2007 MICHIGAN

C-8009

SBT Allocation of Statutory Exemption, Standard Small Business Credit

and Alternate Tax for Members of Controlled Groups

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

1. Name

2. Federal Employer Identification Number (FEIN) or TR Number

PART 1: MEMBER IDENTIFICATION -

Include all members with activity in Michigan whether or not the member is required to file an SBT annual return.

Member Name

Date Tax Year Ends

FEIN or TR Number

Organization Type*

3a.

b.

c.

*Organization Type - Individual, Partnership/LLC Partnership, Corporation, Estate or Trust, or Limited Liability Company - Corp.

PART 2: STATUTORY EXEMPTION

Me

mber identification from Part 1

a.

b.

c.

d. Total

4.

ALLOCATED STATUTORY EXEMPTION

Enter here and on the member's C-8043, line 8

PART 3: ADJUSTED BUSINESS INCOME

Add columns a - c across. Enter total in column d.

5.

Business income from C-8000, line 11

6.

Capital loss carryover or carryback from C-8000, line 21

7.

Net operating loss carryover or carryback

from C-8000, line 22

8a.

Subtotal. Add lines 5, 6 and 7

8b.

Prorated Subtotal. Calendar filers, enter amount from line 8a.

Fiscal filers - See supplemental instructions

9.

Compensation and director fees of active shareholders

from C-8000KC, line 6

10.

Compensation and director fees of officers

from C-8000KC, line 7

11.

Adjusted business income. Add lines 8b-10. If line 11 col. d

is negative, enter 0 on line 15, 100% on line 22, then continue

12.

Gross receipts from C-8000, line 10a or 10b

(whichever applies)

Figure the tax using both the alternate (Part 4) and the standard (Part 5) method. Select the one that gives the lower tax

after credit for the controlled group.

PART 4: ALTERNATE TAX FOR SMALL BUSINESSES

13.

Tax After Investment Tax Credit from C-8000, line 44. If

apportioned or allocated gross receipts are less than

$100,000, enter zero

%

%

%

100%

14.

Divide each column 13a-c by the total in column 13d

15.

Multiply line 11d by 2% (.02). If negative, enter zero

16.

ALTERNATE CREDIT: Subtract line 15 column d from line 13 column d

17a.

Share of credit: Multiply line 16 column d by percentages

on line 14, columns a-c

b.

Reduced credit: Multiply line 17a by reduced credit

percent from table on page 2 of Form C-8000C

18.

Tax after alternate small business credit

Subtract line 17a or b, whichever applies, from line 13

If combined gross receipts (annualized if short period return) exceed $9,000,000, complete Parts 5, 6 and 7. Otherwise,

complete Parts 5 and 7 only.

Continue on page 2.

1

1 2

2