Form Ct-W4 - Employee'S Withholding Certificate

ADVERTISEMENT

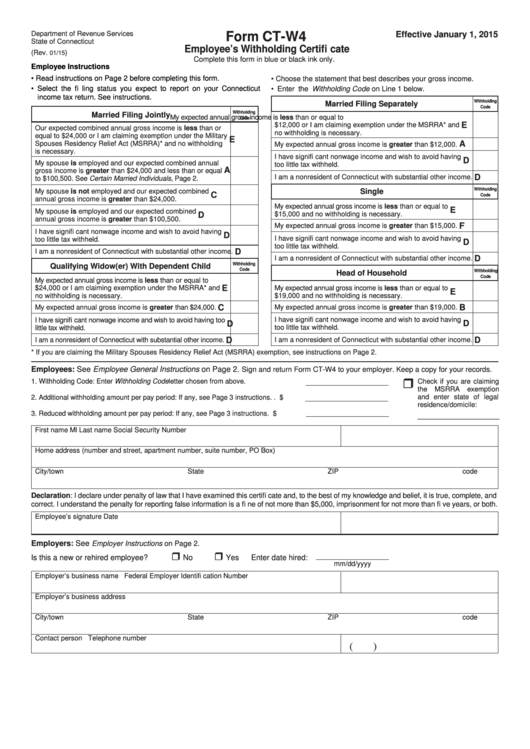

Department of Revenue Services

Form CT-W4

Effective January 1, 2015

State of Connecticut

Employee’s Withholding Certifi cate

(Rev.

)

01/15

Complete this form in blue or black ink only.

Employee Instructions

• Read instructions on Page 2 before completing this form.

• Choose the statement that best describes your gross income.

• Select the fi ling status you expect to report on your Connecticut

• Enter the Withholding Code on Line 1 below.

income tax return. See instructions.

Withholding

Married Filing Separately

Code

Withholding

Married Filing Jointly

My expected annual gross income is less than or equal to

Code

E

$12,000 or I am claiming exemption under the MSRRA* and

Our expected combined annual gross income is less than or

no withholding is necessary.

equal to $24,000 or I am claiming exemption under the Military

E

A

Spouses Residency Relief Act (MSRRA)* and no withholding

My expected annual gross income is greater than $12,000.

is necessary.

I have signifi cant nonwage income and wish to avoid having

D

My spouse is employed and our expected combined annual

too little tax withheld.

A

gross income is greater than $24,000 and less than or equal

D

I am a nonresident of Connecticut with substantial other income.

to $100,500. See Certain Married Individuals, Page 2.

Withholding

My spouse is not employed and our expected combined

Single

C

Code

annual gross income is greater than $24,000.

My expected annual gross income is less than or equal to

E

My spouse is employed and our expected combined

$15,000 and no withholding is necessary.

D

annual gross income is greater than $100,500.

F

My expected annual gross income is greater than $15,000.

I have signifi cant nonwage income and wish to avoid having

D

I have signifi cant nonwage income and wish to avoid having

too little tax withheld.

D

too little tax withheld.

I am a nonresident of Connecticut with substantial other income.

D

D

I am a nonresident of Connecticut with substantial other income.

Withholding

Qualifying Widow(er) With Dependent Child

Code

Withholding

Head of Household

Code

My expected annual gross income is less than or equal to

E

My expected annual gross income is less than or equal to

$24,000 or I am claiming exemption under the MSRRA* and

E

no withholding is necessary.

$19,000 and no withholding is necessary.

B

C

My expected annual gross income is greater than $19,000.

My expected annual gross income is greater than $24,000.

I have signifi cant nonwage income and wish to avoid having

I have signifi cant nonwage income and wish to avoid having too

D

D

too little tax withheld.

little tax withheld.

D

I am a nonresident of Connecticut with substantial other income.

D

I am a nonresident of Connecticut with substantial other income.

* If you are claiming the Military Spouses Residency Relief Act (MSRRA) exemption, see instructions on Page 2.

Employees: See Employee General Instructions on Page 2.

Sign and return Form CT-W4 to your employer. Keep a copy for your records.

1. Withholding Code: Enter Withholding Code letter chosen from above. ....................... 1.

Check if you are claiming

the

MSRRA exemption

and enter state of legal

2. Additional withholding amount per pay period: If any, see Page 3 instructions. . ......... 2. $

residence/domicile:

3. Reduced withholding amount per pay period: If any, see Page 3 instructions. ............ 3. $

_____________________

First name

Ml

Last name

Social Security Number

Home address (number and street, apartment number, suite number, PO Box)

City/town

State

ZIP code

Declaration: I declare under penalty of law that I have examined this certifi cate and, to the best of my knowledge and belief, it is true, complete, and

correct. I understand the penalty for reporting false information is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both.

Employee’s signature

Date

Employers: See

Employer Instructions on Page 2.

No

Yes Enter date hired:

Is this a new or rehired employee?

mm/dd/yyyy

Employer’s business name

Federal Employer Identifi cation Number

Employer’s business address

City/town

State

ZIP code

Contact person

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4