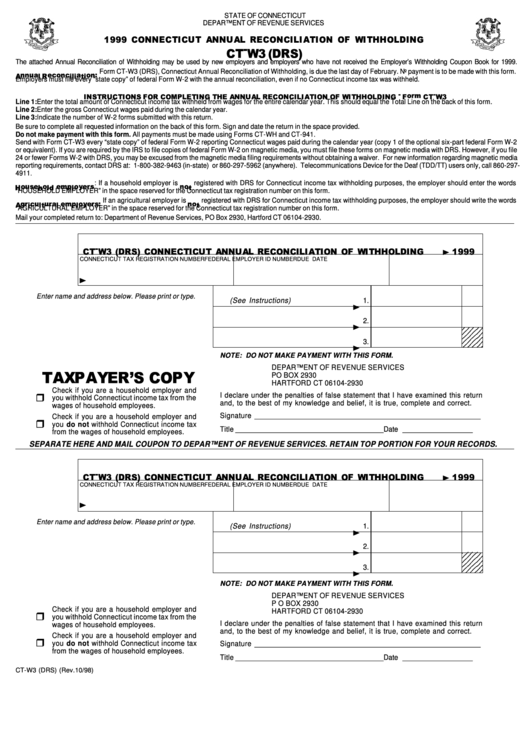

Form Ct-W3 (Drs) - Connecticut Annual Reconciliation Of Withholding - 1999

ADVERTISEMENT

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

The attached Annual Reconciliation of Withholding may be used by new employers and employers who have not received the Employer’s Withholding Coupon Book for 1999.

Form CT-W3 (DRS), Connecticut Annual Reconciliation of Withholding, is due the last day of February. No payment is to be made with this form.

Employers must file every “state copy” of federal Form W-2 with the annual reconciliation, even if no Connecticut income tax was withheld.

Line 1:

Enter the total amount of Connecticut income tax withheld from wages for the entire calendar year. This should equal the Total Line on the back of this form.

Line 2:

Enter the gross Connecticut wages paid during the calendar year.

Line 3:

Indicate the number of W-2 forms submitted with this return.

Be sure to complete all requested information on the back of this form. Sign and date the return in the space provided.

Do not make payment with this form. All payments must be made using Forms CT-WH and CT-941.

Send with Form CT-W3 every “state copy” of federal Form W-2 reporting Connecticut wages paid during the calendar year (copy 1 of the optional six-part federal Form W-2

or equivalent). If you are required by the IRS to file copies of federal Form W-2 on magnetic media, you must file these forms on magnetic media with DRS. However, if you file

24 or fewer Forms W-2 with DRS, you may be excused from the magnetic media filing requirements without obtaining a waiver. For new information regarding magnetic media

reporting requirements, contact DRS at: 1-800-382-9463 (in-state) or 860-297-5962 (anywhere). Telecommunications Device for the Deaf (TDD/TT) users only, call 860-297-

4911.

: If a household employer is

registered with DRS for Connecticut income tax withholding purposes, the employer should enter the words

“HOUSEHOLD EMPLOYER” in the space reserved for the Connecticut tax registration number on this form.

If an agricultural employer is

registered with DRS for Connecticut income tax withholding purposes, the employer should write the words

“AGRICULTURAL EMPLOYER” in the space reserved for the Connecticut tax registration number on this form.

Mail your completed return to: Department of Revenue Services, PO Box 2930, Hartford CT 06104-2930.

CONNECTICUT TAX REGISTRATION NUMBER

FEDERAL EMPLOYER ID NUMBER

DUE DATE

1. Connecticut tax withheld from wages

Enter name and address below. Please print or type.

(See Instructions)

1.

2. Total Connecticut wages reported

2.

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

3. Number of W-2s submitted

3.

1 2 3 4 5

1 2 3 4 5

NOTE: DO NOT MAKE PAYMENT WITH THIS FORM.

DEPARTMENT OF REVENUE SERVICES

PO BOX 2930

HARTFORD CT 06104-2930

Check if you are a household employer and

I declare under the penalties of false statement that I have examined this return

you withhold Connecticut income tax from the

and, to the best of my knowledge and belief, it is true, complete and correct.

wages of household employees.

Signature __________________________________________________________

Check if you are a household employer and

you do not withhold Connecticut income tax

Title ______________________________________ Date __________________

from the wages of household employees.

SEPARATE HERE AND MAIL COUPON TO DEPARTMENT OF REVENUE SERVICES. RETAIN TOP PORTION FOR YOUR RECORDS.

CONNECTICUT TAX REGISTRATION NUMBER

FEDERAL EMPLOYER ID NUMBER

DUE DATE

1. Connecticut tax withheld from wages

Enter name and address below. Please print or type.

(See Instructions)

1.

2. Total Connecticut wages reported

2.

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

3. Number of W-2s submitted

3.

1 2 3 4 5

NOTE: DO NOT MAKE PAYMENT WITH THIS FORM.

DEPARTMENT OF REVENUE SERVICES

P O BOX 2930

Check if you are a household employer and

HARTFORD CT 06104-2930

you withhold Connecticut income tax from the

I declare under the penalties of false statement that I have examined this return

wages of household employees.

and, to the best of my knowledge and belief, it is true, complete and correct.

Check if you are a household employer and

you do not withhold Connecticut income tax

Signature __________________________________________________________

from the wages of household employees.

Title ______________________________________ Date __________________

CT-W3 (DRS) (Rev.10/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2