Publication 936 - Home Mortgage Interest Deduction - Department Of Treasury - 2008 Page 9

ADVERTISEMENT

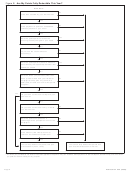

Figure C.

•

acquisition debt after that time. Similarly, a debt

Does not qualify as home acquisition debt

that you use to buy property may not qualify

or as grandfathered debt, and

Home

because the property is not a qualified home.

•

Is secured by your qualified home.

John

Completed

However, if the property later becomes a quali-

Starts

($45,000 in

$36,000

fied home, the debt may qualify after that time.

Building

Personal

Mortgage

Example. You bought your home for cash

Mortgage treated as used to buy, build, or

Home

Funds Used)

Taken Out

10 years ago. You did not have a mortgage on

improve home. A mortgage secured by a

your home until last year, when you took out a

qualified home may be treated as home acquisi-

$20,000 loan, secured by your home, to pay for

tion debt, even if you do not actually use the

your daughter’s college tuition and your father’s

Jan. 31

Oct. 31

Nov. 21

proceeds to buy, build, or substantially improve

medical bills. This loan is home equity debt.

the home. This applies in the following situa-

tions.

Home equity debt limit. There is a limit on the

amount of debt that can be treated as home

1. You buy your home within 90 days before

equity debt. The total home equity debt on your

9 Months

22 Days

or after the date you take out the mort-

main home and second home is limited to the

(Within 24 Months)

(Within 90 Days)

gage. The home acquisition debt is limited

smaller of:

to the home’s cost, plus the cost of any

•

substantial improvements within the limit

Date of the mortgage. The date you take

$100,000 ($50,000 if married filing sepa-

described below in (2) or (3). (See

Exam-

out your mortgage is the day the loan proceeds

rately), or

ple 1

.)

are disbursed. This is generally the closing date.

•

The total of each home’s fair market value

You can treat the day you apply in writing for

2. You build or improve your home and take

(FMV) reduced (but not below zero) by the

your mortgage as the date you take it out. How-

out the mortgage before the work is com-

amount of its home acquisition debt and

ever, this applies only if you receive the loan

pleted. The home acquisition debt is lim-

grandfathered debt. Determine the FMV

proceeds within a reasonable time (such as

ited to the amount of the expenses

and the outstanding home acquisition and

within 30 days) after your application is ap-

incurred within 24 months before the date

grandfathered debt for each home on the

proved. If a timely application you make is re-

of the mortgage.

date that the last debt was secured by the

jected, a reasonable additional time will be

home.

3. You build or improve your home and take

allowed to make a new application.

out the mortgage within 90 days after the

Cost of home or improvements. To deter-

work is completed. The home acquisition

Example. You own one home that you

mine your cost, include amounts paid to acquire

debt is limited to the amount of the ex-

bought in 2000. Its FMV now is $110,000, and

any interest in a qualified home or to substan-

penses incurred within the period begin-

the current balance on your original mortgage

tially improve the home.

ning 24 months before the work is

(home acquisition debt) is $95,000. Bank M of-

completed and ending on the date of the

The cost of building or substantially improv-

fers you a home mortgage loan of 125% of the

mortgage. (See

Example

2.)

ing a qualified home includes the costs to ac-

FMV of the home less any outstanding mort-

quire real property and building materials, fees

gages or other liens. To consolidate some of

for architects and design plans, and required

your other debts, you take out a $42,500 home

Example 1. You bought your main home on

building permits.

mortgage loan [(125% × $110,000) − $95,000]

June 3 for $175,000. You paid for the home with

with Bank M.

cash you got from the sale of your old home. On

Substantial improvement. An improve-

Your home equity debt is limited to $15,000.

July 15, you took out a mortgage of $150,000

ment is substantial if it:

This is the smaller of:

secured by your main home. You used the

•

Adds to the value of your home,

$150,000 to invest in stocks. You can treat the

•

$100,000, the maximum limit, or

•

mortgage as taken out to buy your home be-

Prolongs your home’s useful life, or

•

$15,000, the amount that the FMV of

cause you bought the home within 90 days

•

Adapts your home to new uses.

$110,000 exceeds the amount of home

before you took out the mortgage. The entire

acquisition debt of $95,000.

mortgage qualifies as home acquisition debt be-

Repairs that maintain your home in good con-

cause it was not more than the home’s cost.

dition, such as repainting your home, are not

Debt higher than limit.

Interest on

substantial improvements. However, if you paint

amounts over the home equity debt limit (such

Example 2. On January 31, John began

your home as part of a renovation that substan-

as the interest on $27,500 [$42,500 − $15,000]

building a home on the lot that he owned. He

tially improves your qualified home, you can

in the preceding example) generally is treated

used $45,000 of his personal funds to build the

include the painting costs in the cost of the

as personal interest and is not deductible. But if

home. The home was completed on October 31.

improvements.

the proceeds of the loan were used for invest-

On November 21, John took out a $36,000 mort-

ment, business, or other deductible purposes,

gage that was secured by the home. The mort-

Acquiring an interest in a home because of

the interest may be deductible. If it is, see the

gage can be treated as used to build the home

a divorce. If you incur debt to acquire the

Table 1 Instructions for line 13 for an explanation

because it was taken out within 90 days after the

interest of a spouse or former spouse in a home,

of how to allocate the excess interest.

home was completed. The entire mortgage

because of a divorce or legal separation, you

qualifies as home acquisition debt because it

can treat that debt as home acquisition debt.

Part of home not a qualified home. To

was not more than the expenses incurred within

figure the limit on your home equity debt, you

Part of home not a qualified home. To

the period beginning 24 months before the

must divide the FMV of your home between the

figure your home acquisition debt, you must

home was completed. This is illustrated by Fig-

part that is a qualified home and any part that is

divide the cost of your home and improvements

ure C.

not a qualified home. See

Divided use of your

between the part of your home that is a qualified

home

under Qualified Home in Part I.

home and any part that is not a qualified home.

See

Divided use of your home

under Qualified

Fair market value (FMV). This is the price

Home in Part I.

at which the home would change hands be-

tween you and a buyer, neither having to sell or

Home Equity Debt

buy, and both having reasonable knowledge of

all relevant facts. Sales of similar homes in your

If you took out a loan for reasons other than to

area, on about the same date your last debt was

buy, build, or substantially improve your home, it

secured by the home, may be helpful in figuring

may qualify as home equity debt. In addition,

the FMV.

debt you incurred to buy, build, or substantially

Grandfathered Debt

improve your home, to the extent it is more than

the home acquisition debt limit (discussed ear-

lier), may qualify as home equity debt.

If you took out a mortgage on your home before

Home equity debt is a mortgage you took out

October 14, 1987, or you refinanced such a

after October 13, 1987, that:

mortgage, it may qualify as grandfathered debt.

Publication 936 (2008)

Page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16