Publication 936 - Home Mortgage Interest Deduction - Department Of Treasury - 2008 Page 3

ADVERTISEMENT

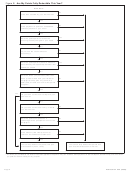

Figure A. Is My Home Mortgage Interest Fully Deductible?

(Instructions: Include balances of ALL mortgages secured by your main home and second home.)

Start Here:

1

Do you meet the conditions

to deduct home

You cannot deduct the interest payments as home

No

4

mortgage interest?

mortgage interest.

Yes

Yes

Were your total mortgage balances $100,000 or

Your home mortgage interest is fully deductible. You

2

less

($50,000 or less if married filing separately) at

do not need to read Part II of this publication.

all times during the year?

No

Were all of your home mortgages taken out on or

Go to Part II of this publication to determine the

Yes

limits on your deductible home mortgage interest.

before 10-13-87?

No

Were all of your home mortgages taken out after

Were your grandfathered debt plus home acquisition

10-13-87 used to buy, build, or improve the main

3

debt balances $1,000,000 or less

($500,000 or less

Yes

home secured by that main home mortgage or used

No

No

if married filing separately) at all times during the

to buy, build, or improve the second home secured

year?

by that second home mortgage, or both?

Yes

Yes

Were the mortgage balances $1,000,000 or less

Were your home equity debt balances $100,000 or

2

($500,000 or less if married filing separately) at all

No

less

($50,000 or less if married filing separately) at

No

times during the year?

all times during the year?

Yes

1

You must itemize deductions on Schedule A (Form 1040) and be legally liable for the loan. The loan must be a secured debt on a qualified home. See

Part I, Home Mortgage Interest.

2

If all mortgages on your main or second home exceed the home’s fair market value, a lower limit may apply. See Home equity debt limit under Home Equity

Debt in Part II.

3

Amounts over the $1,000,000 limit ($500,000 if married filing separately) qualify as home equity debt if they are not more than the total home equity debt

limit. See Part II of this publication for more information about grandfathered debt, home acquisition debt, and home equity debt.

4

See Table 2 in Part II of this publication for where to deduct other types of interest payments.

to be a qualified home. You must use this home

treat as a second home during the year in the

can choose a new second home as of the

following situations.

day you sell the old one or begin using it

more than 14 days or more than 10% of the

as your main home.

number of days during the year that the home is

•

If you get a new home during the year,

rented at a fair rental, whichever is longer. If you

you can choose to treat the new home as

do not use the home long enough, it is consid-

Divided use of your home. The only part of

your second home as of the day you buy

ered rental property and not a second home. For

it.

your home that is considered a qualified home is

the part you use for residential living. If you use

information on residential rental property, see

•

If your main home no longer qualifies as

part of your home for other than residential liv-

Publication 527.

your main home, you can choose to treat it

ing, such as a home office, you must allocate the

as your second home as of the day you

More than one second home. If you have

use of your home. You must then divide both the

stop using it as your main home.

more than one second home, you can treat only

cost and fair market value of your home between

•

one as the qualified second home during any

If your second home is sold during the

the part that is a qualified home and the part that

year. However, you can change the home you

year or becomes your main home, you

is not. Dividing the cost may affect the amount of

Publication 936 (2008)

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16