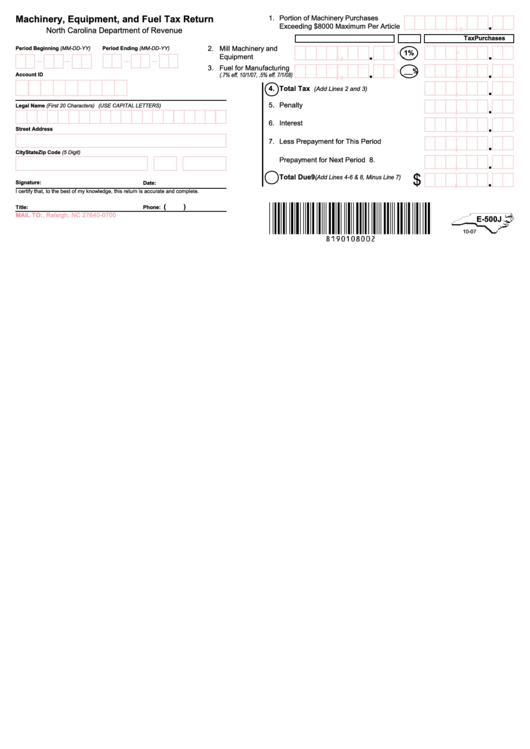

Form E-500j - Machinery, Equipment, And Fuel Tax Return

ADVERTISEMENT

.

,

,

Machinery, Equipment, and Fuel Tax Return

1.

Portion of Machinery Purchases

Exceeding $8000 Maximum Per Article

North Carolina Department of Revenue

Purchases

Rate

Tax

.

.

,

,

,

2.

Mill Machinery and

Period Beginning (MM-DD-YY)

Period Ending (MM-DD-YY)

x

1%

=

Equipment

.

.

,

,

,

3.

Fuel for Manufacturing

x

___%

=

(.7% eff. 10/1/07, .5% eff. 7/1/08)

Account ID

.

,

4.

Total Tax

(Add Lines 2 and 3)

.

,

5.

Penalty

Legal Name (First 20 Characters)

(USE CAPITAL LETTERS)

.

,

6.

Interest

Street Address

.

,

7.

Less Prepayment for This Period

.

City

State

Zip Code (5 Digit)

,

8.

Prepayment for Next Period

.

,

$

9.

Total Due

(Add Lines 4-6 & 8, Minus Line 7)

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

(

)

Title:

Phone:

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0700

E-500J

10-07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1