Calculation Of City Of Oakwood Income Tax Refund & Refund Request Instructions

ADVERTISEMENT

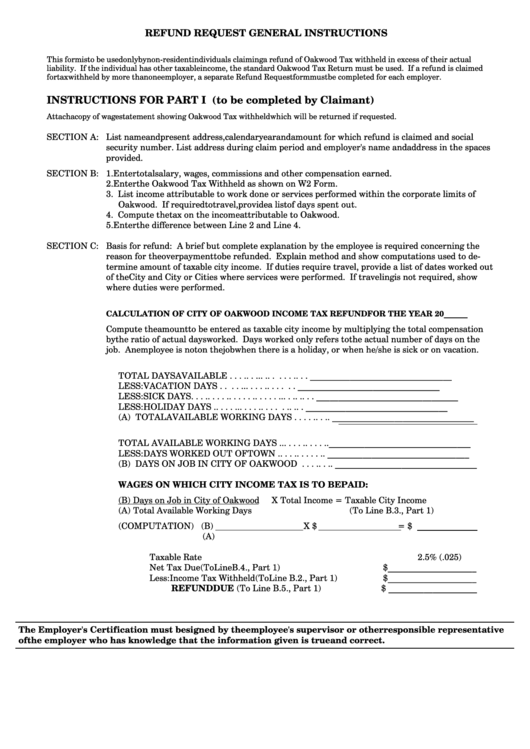

REFUND REQUEST GENERAL INSTRUCTIONS

This form is to be used only by non-resident individuals claiming a refund of Oakwood Tax withheld in excess of their actual

liability. If the individual has other taxable income, the standard Oakwood Tax Return must be used. If a refund is claimed

for tax withheld by more than one employer, a separate Refund Request form must be completed for each employer.

INSTRUCTIONS FOR PART I (to be completed by Claimant)

Attach a copy of wage statement showing Oakwood Tax withheld which will be returned if requested.

SECTION A:

List name and present address, calendar year and amount for which refund is claimed and social

security number. List address during claim period and employer's name and address in the spaces

provided.

SECTION B:

1. Enter total salary, wages, commissions and other compensation earned.

2. Enter the Oakwood Tax Withheld as shown on W2 Form.

3. List income attributable to work done or services performed within the corporate limits of

Oakwood. If required to travel, provide a list of days spent out.

4. Compute the tax on the income attributable to Oakwood.

5. Enter the difference between Line 2 and Line 4.

SECTION C:

Basis for refund: A brief but complete explanation by the employee is required concerning the

reason for the overpayment to be refunded. Explain method and show computations used to de-

termine amount of taxable city income. If duties require travel, provide a list of dates worked out

of the City and City or Cities where services were performed. If traveling is not required, show

where duties were performed.

CALCULATION OF CITY OF OAKWOOD INCOME TAX REFUND FOR THE YEAR 20______

Compute the amount to be entered as taxable city income by multiplying the total compensation

by the ratio of actual days worked. Days worked only refers to the actual number of days on the

job. An employee is not on the job when there is a holiday, or when he/she is sick or on vacation.

TOTAL DAYS AVAILABLE . . . . . . . . . . . . . . . . . . . . . . . ________________________________

LESS: VACATION DAYS . . . . . . . . . . . . . . . . . . . . . . . . . ________________________________

LESS: SICK DAYS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________________

LESS: HOLIDAY DAYS . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________________

(A) TOTAL AVAILABLE WORKING DAYS . . . . . . . . . ________________________________

TOTAL AVAILABLE WORKING DAYS . . . . . . . . . . . . .________________________________

LESS: DAYS WORKED OUT OF TOWN . . . . . . . . . . . . ________________________________

(B) DAYS ON JOB IN CITY OF OAKWOOD . . . . . . . . ________________________________

WAGES ON WHICH CITY INCOME TAX IS TO BE PAID:

(B) Days on Job in City of Oakwood

X Total Income = Taxable City Income

(A) Total Available Working Days

(To Line B.3., Part 1)

(COMPUTATION) (B)

X $

= $

(A)

Taxable Rate

2.5% (.025)

Net Tax Due (To Line B.4., Part 1)

$ ____________________

Less: Income Tax Withheld (To Line B.2., Part 1)

$ ____________________

REFUND DUE (To Line B.5., Part 1)

$ ____________________

The Employer's Certification must be signed by the employee's supervisor or other responsible representative

of the employer who has knowledge that the information given is true and correct.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1