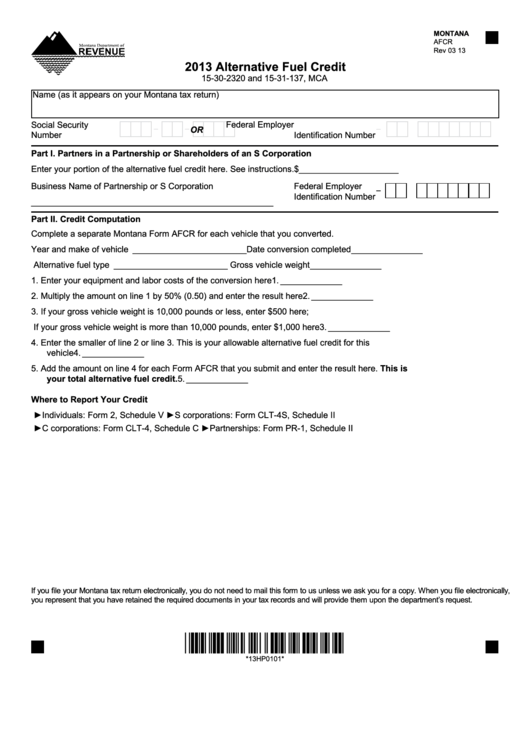

Montana Form Afcr - Alternative Fuel Credit - 2013

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

AFCR

5

5

Rev 03 13

6

6

2013 Alternative Fuel Credit

7

7

8

15-30-2320 and 15-31-137, MCA

8

9

9

Name (as it appears on your Montana tax return)

10

10

100

11

11

12

12

Social Security

Federal Employer

110

120

-

-

-

X X X X X X X X X

X X X X X X X X X

13

OR

13

Number

Identification Number

14

14

15

15

Part I. Partners in a Partnership or Shareholders of an S Corporation

150

16

16

Enter your portion of the alternative fuel credit here. See instructions.

$_____________________

17

17

18

18

Business Name of Partnership or S Corporation

Federal Employer

140

-

19

19

130

Identification Number

___________________________________________________

20

20

21

21

Part II. Credit Computation

22

22

Complete a separate Montana Form AFCR for each vehicle that you converted.

23

23

24

160/170

24

180

Year and make of vehicle ________________________Date conversion completed _______________

25

25

190

200

Alternative fuel type ________________________

Gross vehicle weight _______________

26

26

210

27

27

1. Enter your equipment and labor costs of the conversion here ........................................................... 1. _____________

28

28

220

2. Multiply the amount on line 1 by 50% (0.50) and enter the result here .............................................. 2. _____________

29

29

30

30

3. If your gross vehicle weight is 10,000 pounds or less, enter $500 here;

31

230

31

32

If your gross vehicle weight is more than 10,000 pounds, enter $1,000 here .................................... 3. _____________

32

33

33

4. Enter the smaller of line 2 or line 3. This is your allowable alternative fuel credit for this

240

34

34

vehicle ................................................................................................................................................ 4. _____________

35

35

5. Add the amount on line 4 for each Form AFCR that you submit and enter the result here. This is

36

36

250

your total alternative fuel credit. .................................................................................................... 5. _____________

37

37

38

38

Where to Report Your Credit

39

39

40

40

►Individuals: Form 2, Schedule V

►S corporations: Form CLT-4S, Schedule II

41

41

►C corporations: Form CLT-4, Schedule C

►Partnerships: Form PR-1, Schedule II

42

42

43

43

44

44

45

45

46

46

47

47

48

48

49

49

50

50

51

51

52

52

53

53

54

54

55

55

56

56

57

57

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically,

58

58

you represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

59

59

60

60

61

61

62

*13HP0101*

62

63

63

64

64

*13HP0101*

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2