Plan Rollover Contribution Form

Download a blank fillable Plan Rollover Contribution Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Plan Rollover Contribution Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

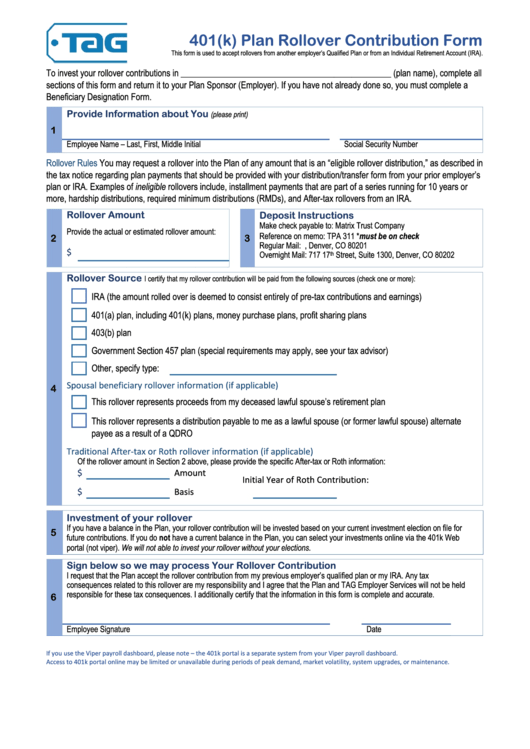

401(k) Plan Rollover Contribution Form

This form is used to accept rollovers from another employer’s Qualified Plan or from an Individual Retirement Account (IRA).

To invest your rollover contributions in ________________________________________________ (plan name), complete all

sections of this form and return it to your Plan Sponsor (Employer). If you have not already done so, you must complete a

Beneficiary Designation Form.

Provide Information about You

(please print)

1

Employee Name – Last, First, Middle Initial

Social Security Number

Rollover Rules

You may request a rollover into the Plan of any amount that is an “eligible rollover distribution,” as described in

the tax notice regarding plan payments that should be provided with your distribution/transfer form from your prior employer’s

plan or IRA. Examples of ineligible rollovers include, installment payments that are part of a series running for 10 years or

more, hardship distributions, required minimum distributions (RMDs), and After-tax rollovers from an IRA.

Deposit Instructions

Rollover Amount

Make check payable to: Matrix Trust Company

Provide the actual or estimated rollover amount:

Reference on memo: TPA 311 *must be on check

2

3

Regular Mail: P.O. Box 46546, Denver, CO 80201

$

Overnight Mail: 717 17

Street, Suite 1300, Denver, CO 80202

th

Rollover Source

I certify that my rollover contribution will be paid from the following sources (check one or more):

IRA (the amount rolled over is deemed to consist entirely of pre-tax contributions and earnings)

401(a) plan, including 401(k) plans, money purchase plans, profit sharing plans

403(b) plan

Government Section 457 plan (special requirements may apply, see your tax advisor)

Other, specify type:

Spousal beneficiary rollover information (if applicable)

4

This rollover represents proceeds from my deceased lawful spouse’s retirement plan

This rollover represents a distribution payable to me as a lawful spouse (or former lawful spouse) alternate

payee as a result of a QDRO

Traditional After-tax or Roth rollover information (if applicable)

Of the rollover amount in Section 2 above, please provide the specific After-tax or Roth information:

$

Amount

Initial Year of Roth Contribution:

$

Basis

Investment of your rollover

If you have a balance in the Plan, your rollover contribution will be invested based on your current investment election on file for

5

future contributions. If you do not have a current balance in the Plan, you can select your investments online via the 401k Web

portal (not viper). We will not able to invest your rollover without your elections.

Sign below so we may process Your Rollover Contribution

I request that the Plan accept the rollover contribution from my previous employer’s qualified plan or my IRA. Any tax

consequences related to this rollover are my responsibility and I agree that the Plan and TAG Employer Services will not be held

responsible for these tax consequences. I additionally certify that the information in this form is complete and accurate.

6

Employee Signature

Date

If you use the Viper payroll dashboard, please note – the 401k portal is a separate system from your Viper payroll dashboard.

Access to 401k portal online may be limited or unavailable during periods of peak demand, market volatility, system upgrades, or maintenance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1